Politics

OPP Issues Urgent Warning Over Scam Impersonating Crown Attorney's Office

The Ontario Provincial Police are alerting the public about a sophisticated scam where fraudsters pose as Crown Attorney's office officials to extort money.

Business

Iconic Canadian Brand Roots Announces Strategic Review That Could Lead to Sale

The iconic Canadian lifestyle brand Roots has initiated a strategic review that may include selling the company. Founded in 1973, Roots has hired financial and legal advisers to explore options.

Sports

Max Scherzer Calls Daughter's Letter to Blue Jays 'The Cutest Thing'

Toronto Blue Jays pitcher Max Scherzer shares a heartwarming story about his daughter's letter to the team, calling it an adorable moment that touched his heart.

Lifestyle

17 At-Home Spa Tools That Will Save You Time And Money

Discover a curated list of 17 at-home spa tools designed to help you save both time and money while enjoying professional-grade self-care treatments from the comfort of your home.

Environment

Health

AlayaCare AI Saves Home Care Agencies 80% Time and Costs

AlayaCare introduces AI-powered autonomous agents to streamline home care operations, reducing manual workload by up to 80% and enhancing caregiver efficiency with features like automated visit verification and care plan drafting.

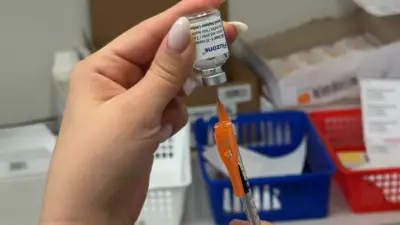

Alberta's 2025-26 Flu Season Deadliest in Recent History

New data from the Alberta government shows the 2025-26 influenza season was the most lethal in recent memory, highlighting severe public health impacts.

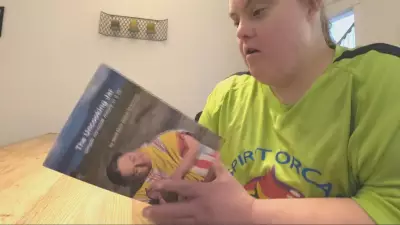

Blind Athlete with Down Syndrome Publishes Un-Cookbook

A legally blind swimmer with Down syndrome overcomes adversity to publish an un-cookbook, inspiring others to break barriers in the kitchen and beyond.

Toronto Won't Suspend Students Over Vaccine Records

Toronto Public Health announces it will not suspend students for incomplete immunization records this academic year, marking a shift in enforcement policy.

Alberta Budget 2026: Billions for Hospitals, Surgery

Alberta's provincial government announces Budget 2026 will allocate billions to enhance acute care, including hospital expansions and surgical services, pending legislative approval.

Education

Get Updates

Subscribe to our newsletter to receive the latest updates in your inbox!

We hate spammers and never send spam