Electric vehicles manufactured in China have taken the global market by storm, yet they remain a rare sight on Canadian and American roads. This is set to change following a significant new trade arrangement announced by Prime Minister Mark Carney.

The Tariff Wall Comes Down

The primary reason for the absence of popular Chinese EV brands like BYD and Nio in North America has been a prohibitive 100 per cent import tariff imposed by both Canada and the United States. This policy effectively doubled the cost for consumers, keeping these vehicles out of the market.

This barrier is now being lowered. During a recent trip to Beijing for meetings with President Xi Jinping, Prime Minister Carney announced a "landmark trade arrangement." The deal, expected to be finalized Friday, will see China reduce tariffs on Canadian canola in exchange for Canada allowing a number of Chinese-made electric vehicles into the country at a preferential tariff rate.

China's Dominance in the EV Race

This move could position Canada as the next competitive arena for Chinese EVs, which have been outperforming rivals worldwide. China has solidified its position as the world's electric vehicle manufacturing and export powerhouse.

The numbers are staggering. Of the roughly 90 million EVs produced globally last year, China was responsible for approximately 35 million. This dwarfs the output of the United States, which manufactured about 11 million, and Canada, which produced less than two million.

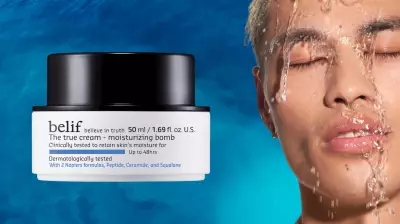

Chinese EVs often come with a compelling combination of lower price and advanced technology. The design appeal is also notable; for instance, the head of design for China's leading EV maker, BYD Auto, is Wolfgang Egger, the former design chief for luxury brands Alfa Romeo, Audi, and Lamborghini.

A Strategy Decades in the Making

China's ascent in the electric vehicle sector is no accident. It began with a strategic government shift in 2008 to prioritize EVs for its massive domestic market. The state provided enormous support, including generous subsidies and incentives for consumers to switch from gasoline cars to electric.

This policy sparked immense domestic demand, allowing Chinese manufacturers to refine technology, scale up production, and drive down costs through volume. After years of development, Chinese EV sales skyrocketed in the last five years.

In 2024 alone, an estimated 11 million domestically made EVs were sold in China, where about one in every ten cars on the road is now electric. Brands like BYD, Nio, Aito, and Wuling HongGuang became mainstream hits as their prices became competitive with, or even cheaper than, conventional cars.

According to the International Energy Agency (IEA), most EVs sold in China are now cheaper than their gasoline-powered counterparts. This stands in sharp contrast to the United States, where EVs typically carry a price premium of around 30 per cent.

The impending arrival of these vehicles in Canada is not without controversy. Critics argue that Chinese EVs benefit from substantial state support, giving them an unfair advantage when they enter foreign markets. The deal promises to reshape the Canadian automotive landscape, offering consumers more choice and potentially lower prices, while posing a significant challenge to established automakers.