Canadian Business Leaders Express Deepening Economic Concerns

Chief executives in Canada are exhibiting markedly greater pessimism about both domestic and global economic conditions compared to their international peers, according to the 2026 Global CEO Survey conducted by PricewaterhouseCoopers LLP. This represents the first instance in five years where Canadian business leader sentiment has diverged from the generally more optimistic outlook observed worldwide.

Sharp Decline in Economic Confidence

The survey data reveals a substantial drop in confidence among Canadian business leaders. Only 27 percent of Canadian CEOs anticipate improvement in the country's economy over the next twelve months, a significant decrease from the 42 percent who expressed optimism in the previous year. Furthermore, just 47 percent of Canadian executives expect the global economy to improve during the same period, compared to 61 percent of CEOs globally.

The comprehensive survey was conducted during October and November, gathering responses from 133 Canadian business leaders alongside more than 4,500 global chief executives. The findings highlight a notable shift in perspective among Canada's corporate leadership.

Key Factors Driving Pessimistic Outlook

Nicolas Marcoux, Chief Executive of PwC Canada, identified several critical factors contributing to the gloomy sentiment among Canadian business leaders. Strained trade and diplomatic relations between Ottawa and Washington, increasing geopolitical instability worldwide, and slower adoption of transformative technologies like artificial intelligence have collectively dampened executive confidence.

More than half of Canadian CEOs express concern about potential impacts from United States trade policy on Canadian operations. Specifically, 35 percent anticipate that tariffs will reduce their company profits over the coming year, while an equal percentage rank geopolitical disruption among their top three business concerns. This contrasts sharply with global CEOs, among whom only 21 percent share similar geopolitical concerns.

Trade Agreement Uncertainty Weighs Heavily

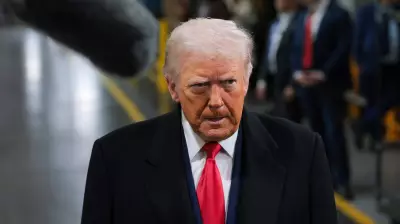

Marcoux emphasized that greater clarity regarding the future of the Canada-U.S.-Mexico Agreement would significantly boost Canadian executive confidence. The trade agreement is scheduled for review this July, but recent comments from U.S. President Donald Trump describing the pact as irrelevant for the United States have heightened uncertainty.

Capital craves certainty, and there's a lot of uncertainty right now around the Canadian economy, Marcoux stated. If we could get to some sort of resolution on CUSMA — with a deal or even to know if there won't be a deal — then I think capital will start to flow into Canada.

Investment Attractiveness Declines

The survey results indicate that Canada's position as an investment destination has weakened. The country has fallen four spots to number twelve on the list of nations where global CEOs prefer to invest. The top four positions are currently held by the United States, the United Kingdom, Germany, and India.

Canadian executives acknowledge that their companies are lagging in artificial intelligence adoption compared to international counterparts. Marcoux stressed the need for policy improvements to enhance Canada's investment appeal, stating, We need to make Canada more attractive for investment, whether it's through better taxation or making it easier to build stuff in Canada. He added that attracting just a few key CEOs could significantly improve the investment landscape.

Silver Linings Amid the Gloom

Despite the overall pessimistic outlook, the survey revealed several positive indicators for Canadian businesses. Canadian CEOs have demonstrated stronger performance in diversification efforts, with 56 percent reporting they have expanded their companies into new sectors over the past five years, compared to just 42 percent of global CEOs.

Additionally, Canadian executives remain equally confident as their global peers regarding their own company's prospects. Forty-nine percent of both Canadian and global CEOs expect their company's revenue to grow over the next three years, indicating that while macroeconomic concerns persist, corporate leadership maintains faith in their individual organizations.

That's a significant shift, Marcoux observed. There's a connection with the situation vis-a-vis CUSMA where Canadian CEOs are looking at new markets, not just geographic markets but also other product lines.

The survey findings suggest that while Canadian business leaders face substantial challenges in the current economic environment, their strategic responses through diversification and focus on corporate growth may provide resilience against broader economic headwinds.