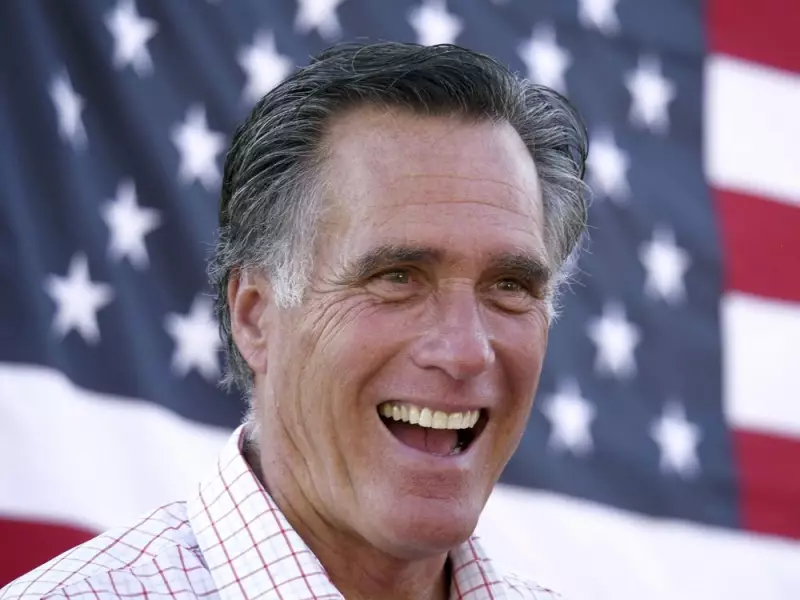

Mitt Romney's Controversial Tax Stance Ignites Fiscal Policy Debate

In a surprising political development, former Republican presidential nominee Mitt Romney has stirred significant controversy with his recent public support for tax increases. The Utah senator's position, articulated in a detailed letter to The Wall Street Journal, has placed him at odds with traditional Republican fiscal philosophy and sparked intense debate about America's economic future.

Romney's Democratic-Leaning Fiscal Position

Romney's letter reveals a significant departure from conventional Republican thinking on taxation. The former Massachusetts governor wrote that he accepts tax increases because "continuing to add to the national debt at a rate far greater than the growth of the economy can't go on forever." This stance has drawn criticism from fiscal conservatives who argue that spending reduction, not revenue enhancement, should be the primary focus of debt management strategies.

The timing of Romney's comments coincides with critical congressional debates over funding bills that could prevent another potential government shutdown. Democrats have been pushing to either defund or significantly reduce the budget of Immigration and Customs Enforcement (ICE), creating additional tension in Washington's fiscal negotiations.

Record Revenue Versus Soaring Debt

Current economic data presents a complex fiscal picture that challenges Romney's tax increase argument. The U.S. government has been collecting record amounts of revenue, with total receipts exceeding $5 trillion in Fiscal Year 2025. Individual income taxes have reached unprecedented levels in recent years, significantly bolstering federal coffers. These revenue surges have been partly driven by increased tariff collections under former President Donald Trump's trade policies.

Despite these substantial revenue streams, the national debt continues its alarming ascent toward $39 trillion. This disconnect between record income and escalating debt highlights what critics identify as the core problem: uncontrolled government spending rather than insufficient revenue collection.

The Spending Dilemma and Political Realities

Fiscal analysts point to persistent spending increases as the primary driver of America's debt crisis. Even with revenue at historic highs, congressional reluctance to implement meaningful spending reductions continues to fuel deficit growth. The political landscape complicates this issue, with approximately one-third of Americans receiving some form of government assistance according to 2023 Department of Health and Human Services estimates.

This widespread dependency on government programs creates significant political resistance to spending cuts. Democrats and media outlets frequently protest even modest proposals to reduce spending growth or eliminate fraudulent expenditures, creating a challenging environment for fiscal reform advocates.

Historical Perspective and Moral Considerations

Romney's tax increase stance contrasts sharply with traditional conservative fiscal philosophy exemplified by President Ronald Reagan. In a 1985 address to the nation, Reagan emphasized that "no matter how much more tax money comes to Washington, it won't amount to a hill of beans if government won't curb its endless appetite to spend."

The late president framed fiscal responsibility as a moral imperative, stating that "every dollar the government spends comes out of your pockets" and that officials have a duty to "spend wisely and carefully and, just as important, fairly." This perspective suggests that before considering additional revenue collection, policymakers should first demonstrate commitment to spending restraint and efficiency.

The Path Forward for Fiscal Responsibility

Romney concluded his controversial letter by asserting that "I'm a great deal more concerned about the future of the country than the size of my tax bill." Critics argue that if this concern is genuine, the senator should prioritize spending reduction and debt management before advocating for increased taxation.

The fundamental question remains whether Washington can address its fiscal challenges through spending discipline or whether additional revenue collection represents a necessary component of debt reduction. As the national debt continues its upward trajectory, this debate takes on increasing urgency for America's economic stability and future generations' prosperity.