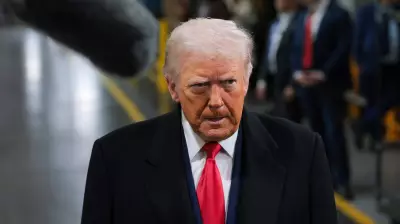

The U.S. stock market exhibited a tentative stabilization on Wednesday, attempting to recover from its most severe single-day decline since October. This modest rebound occurred despite persistent undercurrents of apprehension on Wall Street, largely fueled by President Donald Trump's expressed interest in acquiring Greenland.

Market Indicators Show Cautious Optimism

Following a speech in Europe where President Trump clarified he would not employ force to obtain what he termed "the piece of ice," the S&P 500 index rose by 0.3%. This gain recouped a fraction of the previous day's substantial 2.1% drop, inching the benchmark closer to the all-time high it achieved earlier in the month. The Dow Jones Industrial Average advanced by 200 points, or 0.4%, as of 9:35 a.m. Eastern Time, while the Nasdaq composite saw a more modest increase of 0.1%.

President Trump himself addressed the market's reaction, acknowledging that his Greenland comments contributed to Tuesday's downturn. However, he characterized the drop as "peanuts compared to what it's gone up" during the initial year of his second term and expressed confidence in future market growth.

Corporate Earnings Provide Mixed Signals

Several major corporations reported quarterly results, influencing sector performance. Halliburton, the oilfield services provider, saw its shares climb 3.6% after announcing a profit that surpassed analyst expectations. Similarly, United Airlines enjoyed a 3.5% increase following a better-than-anticipated profit report for the end of 2025. CEO Scott Kirby noted the airline's robust revenue momentum is projected to continue into 2026.

These gains were partially offset by significant declines elsewhere. Netflix tumbled 4.8% as investors focused on a slowdown in subscriber growth, overshadowing a stronger-than-expected profit report. Kraft Heinz experienced a more pronounced drop of 6.6% after Berkshire Hathaway indicated a potential interest in divesting its substantial stake in the food giant. This warning follows a series of developments, including a multi-billion dollar write-down by Berkshire and the resignation of its board representatives from Kraft last spring.

Bond Markets and Global Influences

In the bond market, Treasury yields exhibited greater stability after a notable jump the prior day, which had signaled potential long-term inflation concerns. The yield on the 10-year Treasury note eased slightly to 4.28% from 4.30%. Despite this minor retreat, it remains elevated compared to levels seen before President Trump's announcement of impending 10% tariffs on several European nations, set to commence in February.

Concurrently, the price of gold, often viewed as a safe-haven asset during periods of uncertainty, surged another 1.9%, breaching the $4,800 per ounce threshold for the first time. This movement suggests that some investor nervousness persists within the market.

International Developments and Commodities

Abroad, stock indexes in Europe and Asia displayed mixed, generally subdued movements. Japan's Nikkei 225 index slipped 0.4% amid domestic political developments. Prime Minister Sanae Takaichi called a snap election for February 8th, a move that initially sent long-term Japanese government bond yields to record highs. The political shift raises expectations of tax cuts and increased spending, adding complexity to Japan's management of its considerable public debt.

In commodity markets, natural gas futures rallied by more than 8%, driven by anticipatory demand for heating as severe winter storms and a cold snap impacted large regions of the United States.

The day's trading reflects a financial landscape grappling with geopolitical statements, corporate earnings surprises, and international economic policy shifts, illustrating the interconnected nature of modern global markets.