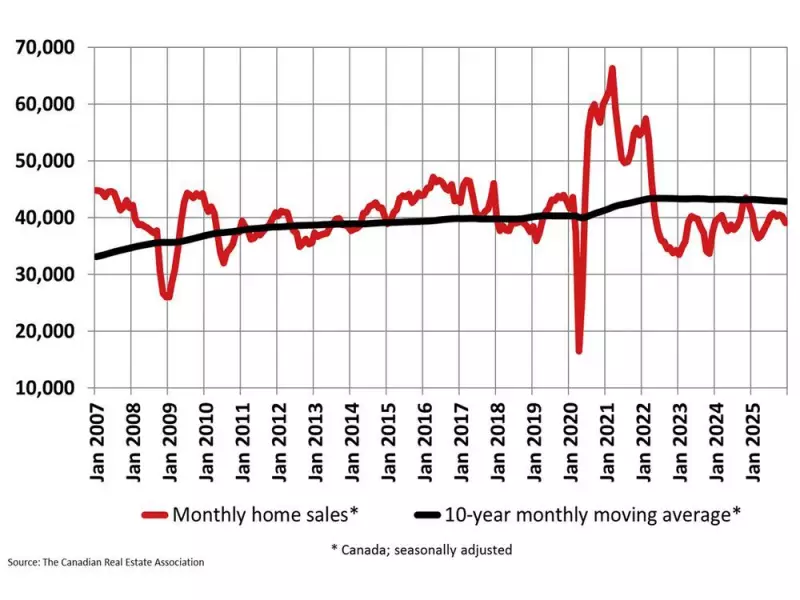

The Canadian housing market closed out 2025 on a subdued note, with a monthly decline in sales activity suggesting a quiet end to a turbulent year. According to data released by the Canadian Real Estate Association (CREA), the number of home sales processed through MLS® Systems across the country fell by 2.7% in December 2025 compared to November.

A Year Marked by Shifting Momentum

On an annual basis, the total transaction count for 2025 reached 470,314 units, representing a decrease of 1.9% from the 2024 total. The year unfolded in distinct phases: an initial retreat of buyers in the first quarter, largely attributed to economic uncertainty and policy changes, was followed by a noticeable rebound in sales during the middle of the year. However, this recovery lost steam as the calendar year drew to a close.

Shaun Cathcart, CREA’s Senior Economist, commented on the December slowdown, noting it appeared to be a coincidental dip across several major markets rather than a single, nationwide trend. "There doesn’t appear to have been much rhyme or reason to the month-over-month decline in home sales in December," Cathcart said, pointing to seemingly unrelated slowdowns in Vancouver, Calgary, Edmonton, and Montreal.

Key Metrics from December's Market Report

The monthly data revealed several important indicators for the health of the national market:

- Actual (not seasonally adjusted) sales activity was 4.5% below the level recorded in December 2024.

- The supply of new listings also contracted, dropping 2% from the previous month.

- The benchmark MLS® Home Price Index (HPI) dipped 0.3% month-over-month and was down 4% compared to December 2024.

- The actual national average sale price was virtually stable, showing a negligible year-over-year change of -0.1%.

Market Balance and Inventory Trends

The decline in new listings marked the fourth consecutive monthly drop. With sales falling slightly more than new supply, the sales-to-new listings ratio eased to 52.3% in December from 52.7% in November. This ratio continues to hover near the long-term national average of 54.9%, indicating market conditions remain broadly balanced.

Active inventory levels told another story. There were 133,495 properties listed for sale on Canadian MLS® Systems at the end of December 2025. This was a 7.4% increase from the same time last year, but still 9.9% below the long-term average for the month. Notably, inventory levels have been declining since May 2025 due to the mid-year surge in demand.

Looking Ahead to the 2026 Spring Market

Despite the quiet finish, industry leaders express cautious optimism for the coming year. Cathcart advised against extrapolating December's weakness into 2026, forecasting that sales are likely to resume an upward trend as the spring market approaches, mirroring the pattern seen in the spring and summer of 2025.

CREA Chair Valérie Paquin echoed this sentiment, pointing to underlying factors that could fuel activity. "The spring market is now just around the corner, and it is expected to benefit from four years of pent-up demand, and interest rates that at this point are about as good as they are going to get," Paquin stated. She suggested that, barring major new economic shocks, 2026 should see a more active market, encouraging potential buyers and sellers to engage with a local REALTOR® to prepare.