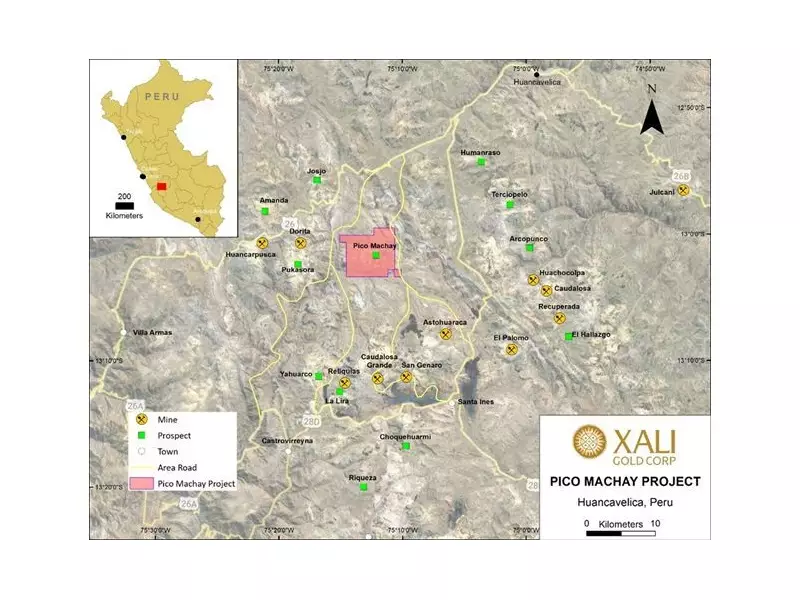

Vancouver-based Xali Gold Corp. has successfully completed a significant acquisition, solidifying its foothold in Peru's mining sector. The company announced on December 24, 2025, that it has formally closed the deal to acquire the Pico Machay Gold Project, an advanced exploration-stage asset with clear near-term production objectives.

Strategic Acquisition and Immediate Plans

The transaction involved Xali Gold acquiring Minera Calipuy S.A.C., the sole owner of the Pico Machay project, from sellers Pan American Silver Corp. and its subsidiary, Aquiline Resources Inc. With the deal now finalized, the company's leadership is shifting its focus to rapid development.

"Our full attention turns to advancing the asset and unlocking its value," stated Joanne Freeze, President and CEO of Xali Gold. She highlighted a compelling opportunity, noting that the project's historical resource was calculated using a conservative gold price of US$700 per ounce. In today's market, this discrepancy presents substantial potential. The company's immediate priorities include updating the historical resource estimate and optimizing previous engineering studies, which outlined a low-cost, open-pit heap-leach operation.

Structured Payment Terms Totaling $17 Million

The acquisition is structured with a multi-year payment plan. To close the deal on December 24, 2025, Xali Gold made an initial cash payment of US$500,000. The remaining financial commitment is spread across several milestone dates:

- December 24, 2026: $1.5 million

- December 24, 2027: $1.5 million

- December 24, 2028: $4.0 million

- December 24, 2029: $3.0 million

- Earlier of December 24, 2030, or commercial production start: $4.5 million

An additional contingent payment of $2.5 million is due if a subsequent technical report confirms aggregate mineral resources or reserves exceeding 1.25 million ounces of gold for the project. This brings the total potential deal value to US$17.0 million.

Security and Guarantees for the Deal

The deferred payments are secured through a series of legal and financial instruments. Xali Gold has provided Promissory Notes for each of the five deferred payments and the contingent payment. These notes are backed by a first-priority Share Pledge Agreement on 100% of Calipuy's shares and a first-priority Mortgage Agreement covering both the Pico Machay project and Xali Gold's Las Brujas II property in Peru.

The Promissory Notes are unconditionally guaranteed by Calipuy and Candente Gold Peru S.A.C. They are non-convertible into securities and do not accrue interest before their maturity dates. However, a failure to pay on the due date triggers a default interest rate set at the Federal Funds Rate plus 800 basis points. The company confirmed the transaction was conducted on an arm's length basis, with no finder's fees paid.

This acquisition marks a pivotal step for Xali Gold as it seeks to transform the Pico Machay project from an advanced exploration asset into a producing gold mine, capitalizing on current favorable market conditions for the precious metal.