Verde AgriTech Announces Record-Breaking Rare Earth Intercepts in Brazilian Drilling Program

Verde AgriTech Ltd., a Canadian-listed company trading on the TSX under NPK and OTCQX as VNPKF, has released highly encouraging assay results from its ongoing drilling campaign at the Minas Americas Global Alliance Project located in Minas Gerais, Brazil. The company reports a new best intercept to date, with significant mineralization that underscores the project's potential for rare earth element extraction.

Exceptional Drilling Performance and Mineralization

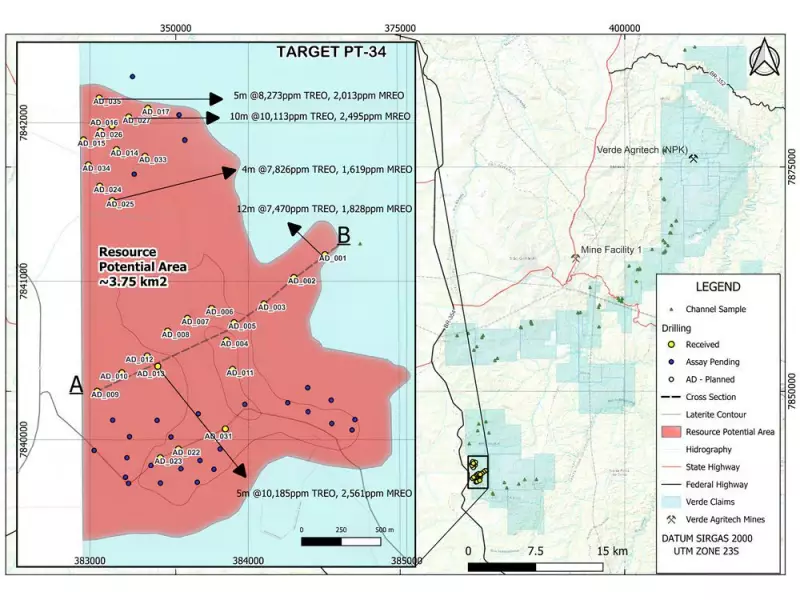

The latest results come from 24 additional holes at the priority PT-34 target, adding 244.7 meters to the drilling program. This brings the total reported results to 27 holes covering 279.8 meters, with 280 assayed intervals analyzed. The standout intercept reveals 13.0 meters from 2.0 to 15.0 meters depth averaging 8,257 parts per million (0.83%) total rare earth oxides (TREO), including a particularly rich 8.0-meter section from 3.0 to 11.0 meters averaging 10,113 ppm (1.01%) TREO.

Notably, 25.4% of the drilled meters at PT-34 have returned grades of 0.40% TREO or higher, demonstrating widespread mineralization. The distribution of high-grade material is substantial, with 71.2 meters achieving this threshold, 46.0 meters reaching ≥0.60% TREO, 23.0 meters at ≥0.80% TREO, and 8.0 meters exceeding 1.00% TREO.

Magnet-Rich Composition and Strategic Implications

The magnetic rare earth oxides (MREO), which include neodymium, praseodymium, dysprosium, and terbium, show a strengthening correlation with higher grades. In intervals with ≥0.40% TREO, MREO averages approximately 23% of the total rare earth content, increasing to about 26% in intervals with ≥1.00% TREO. This magnet-rich basket is particularly valuable for applications in renewable energy technologies and electric vehicles.

Cristiano Veloso, Founder and CEO of Verde, emphasized the significance of these findings. "Our first drilling target is already delivering the combination that matters in rare earth discoveries: shallow thickness, repeated high grades, and a magnet-rich rare earth basket," he stated. "With significant intercepts now extending across PT-34 and multiple holes finishing in mineralization, we are prioritizing scale capture."

Expansion Plans and Regulatory Compliance

In response to the strong results, Verde's Board has approved expanding the resource definition footprint and drilling additional meters to better outline the district-scale potential of the project. The company aims to define more tonnes of higher-quality, magnet-rich mineralization before finalizing scoping-level economics.

Additionally, the Board has directed the company to prepare technical disclosure under Canadian NI 43-101 standards and develop U.S. SEC Regulation S-K Subpart 1300 (S-K 1300) aligned disclosure, including a Technical Report Summary where applicable. This dual-track approach is designed to enhance comparability for global investors and preserve strategic flexibility as the project advances.

Metallurgical Context and Future Steps

Previous metallurgical testing has shown promising indicators, including magnet rare earths comprising over 40% of dissolved rare earth oxides in primary leach solutions, with thorium and uranium reported at or below detection levels in the best intervals. Ongoing work includes deeper follow-up drilling to test below current auger depths where mineralization remains open, drill-based composite metallurgical testing across principal mineralization domains, and continued reporting of drill assays and metallurgical results as they become available.

The company is moving forward with a Preliminary Economic Assessment (PEA) to evaluate the project's economic viability, building on these robust drilling results that highlight the Minas Americas project's potential as a significant source of critical rare earth elements.