Canadian mining company Revival Gold Inc. has taken a decisive step to consolidate its flagship asset, announcing it has formally exercised an option to acquire the entirety of Barrick Mining Corporation's interest in the historic Mercur Gold Project located in Utah.

A Strategic Consolidation for Future Production

The move, finalized on December 22, 2025, marks the culmination of an agreement initially struck in May 2021. By delivering the notice to exercise the option, Revival Gold secures 100% control over Barrick's former stake, a critical move in its strategy to restart operations at the past-producing mine. The option was granted and exercised under the terms of the Mineral Lease and Option to Purchase Agreement dated May 13, 2021, as amended.

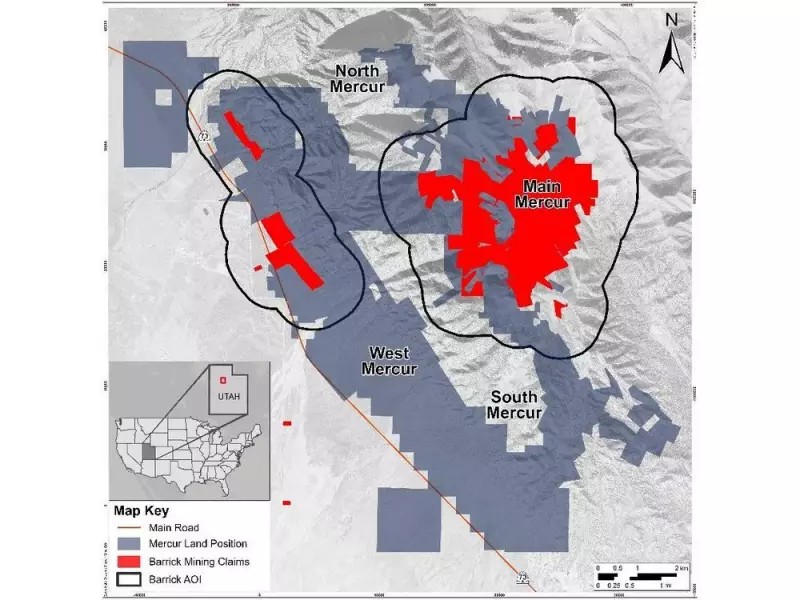

This acquisition adds mineral interests covering 996 hectares to Revival Gold's portfolio. When combined with land previously consolidated from successors to Homestake Mining Company and other owners, the total Mercur project area now encompasses approximately 7,200 hectares.

Project Economics and Development Timeline

Revival Gold is advancing Mercur with clear milestones. The company completed a Preliminary Economic Assessment (PEA) in mid-2025 and executed a 13,000-meter drill program this year. This work is designed to support a planned pre-feasibility study in 2026 and initiate the formal state mine permitting process in Utah.

The PEA outlines a promising economic picture for the Mercur project, which is based on a heap leach operation. Key highlights from the report include:

- An estimated life-of-mine average production of 95,600 ounces of gold per year over a 10-year mine life.

- An after-tax Net Present Value (NPV) of $294 million at a 5% discount rate and a gold price of $2,175 per ounce.

- The NPV demonstrates significant leverage, increasing to $752 million at a gold price of $3,000 per ounce.

- The mine permitting process is anticipated to take about two years to complete.

Leadership Commentary and Transaction Details

Hugh Agro, President and CEO of Revival Gold, emphasized the strategic importance of the consolidation. "Barrick produced 1.4 million ounces of gold at Mercur, but never controlled the contiguous Homestake claims and west Mercur land position," said Agro. "This option exercise completes the consolidation of a large Carlin-style gold system – a rarity outside the Nevada gold majors – and comes with paved road access, an energized powerline to the site and extensive technical information."

Agro identified Mercur as the company's top priority for moving to production, citing Utah as a favourable jurisdiction and expecting a "relatively short timeline to re-permit Mercur for mining." He also noted Revival Gold's commitment to upholding the high environmental and community stewardship standards previously set by Barrick during its operations at the site.

The option exercise follows Revival Gold meeting a key condition of the agreement: incurring at least C$6 million in exploration expenditures prior to January 2, 2026, which the company has completed. To finalize the acquisition, Revival Gold will enter into a membership interest purchase agreement with Barrick Gold Exploration Inc.

The financial compensation to Barrick will be structured as follows, with each payment made in cash or, at Barrick's sole discretion, in Revival Gold common shares:

- US$5 million on the closing of the option.

- US$5 million on each of the first, second, and third anniversaries of commercial production.

This transaction solidifies Revival Gold's control over a significant gold system and positions the company to advance the Mercur project through the next stages of study and permitting toward its goal of renewed production.