Canadian mining company QGold Resources Ltd. has declared 2025 a year of profound transformation, marked by a major acquisition, significant financing, and strategic advancements that set the stage for its 2026 development goals. The Toronto-based firm, trading on the TSX Venture Exchange under QGR, provided a comprehensive year-end overview highlighting progress at its flagship projects in the United States and Canada.

A Strategic Pivot and Financial Foundation

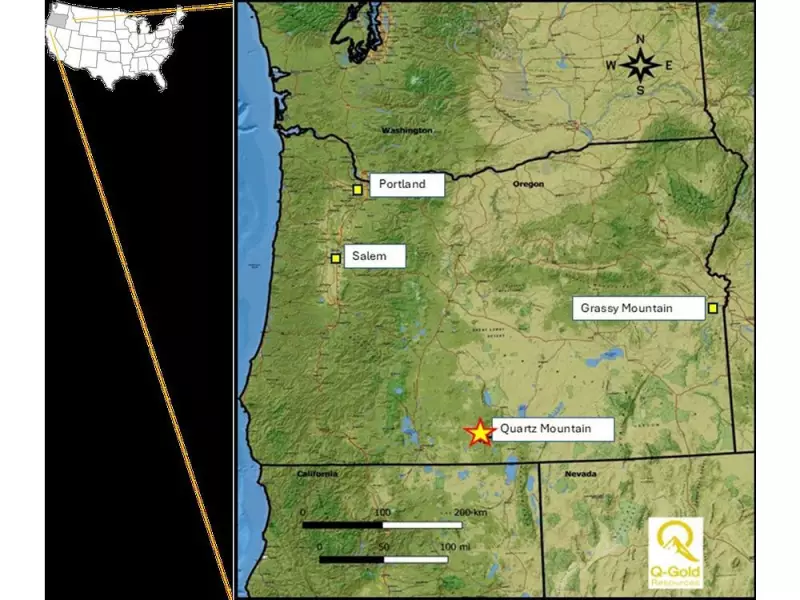

The cornerstone of QGold's transformative year was the successful acquisition of the option to purchase the advanced-stage Quartz Mountain Gold Project from Alamos Gold Inc., finalized on October 22, 2025. This move pivoted the company's focus toward a high-potential asset in Oregon's prolific gold belt.

To fuel this ambitious growth, QGold secured a robust financial backing. On October 3, 2025, the company closed a fully subscribed private placement financing for gross proceeds of $11.5 million, which included a 15% overallotment. BMO Capital Markets acted as the agent for this financing. These funds are earmarked to advance multiple work streams, including economic studies, permitting, and exploration across both the Quartz Mountain project and its Mine Centre gold project in Ontario, Canada.

Building on a Solid Resource Base

Supporting the acquisition, QGold filed a new NI 43-101 technical report featuring an updated mineral resource estimate for the Quartz Mountain Gold Project. This report is critical for investors, as it provides an independent, standardized validation of the project's scale and potential, forming the technical foundation for all future economic assessments.

The company has already initiated the next phase of evaluation. A Preliminary Economic Assessment (PEA) for the Quartz Mountain project is now underway, led by the renowned engineering firm Kappes, Cassiday & Associates. Concurrently, QGold is advancing the project's permitting process with the engagement of SLR International, a global leader in environmental and advisory services.

Expanding Operations and Governance

While focusing on its new U.S. asset, QGold has not neglected its Canadian holdings. The company has initiated two separate drill campaigns at its Mine Centre Gold Project in Ontario, demonstrating a balanced approach to portfolio development.

Strengthening its leadership for this new chapter, QGold bolstered its Board of Directors with two industry veterans. The company welcomed Scott Parsons, Vice President of Exploration at Alamos Gold, and Jamsheed Mehta, the former Vice Chair at BMO Capital Markets. These appointments bring deep technical expertise and formidable financial market experience to the boardroom.

Adding to its corporate milestones, QGold commenced trading on the OTCQB Venture Market in the United States under the symbol "QGLDF," enhancing its visibility and accessibility to a broader range of investors.

The Road to 2026: From Explorer to Developer

President and CEO Peter Tagliamonte summarized the year's achievements, stating the company is now "exceptionally well-positioned" to advance the Quartz Mountain Gold Project. With a strengthened treasury, a validated resource base, and key technical partners in place, QGold's 2026 strategy is clear: to progress through crucial economic studies and permitting with the goal of becoming Oregon's next gold producer.

The Quartz Mountain project itself comprises two contiguous properties—Quartz Mountain and Angel’s Camp—spanning approximately 4,823 acres in south-central Oregon. This sets the stage for what QGold hopes will be the next chapter in its corporate evolution, transitioning from an exploration-focused entity to a developer on the path to production.