Canadian mining company QGold Resources Ltd. has declared 2025 a transformational year, marked by a major acquisition, substantial financing, and strategic advancements that position it for significant growth in 2026. The company, which trades on the TSX Venture Exchange under the symbol QGR, has successfully pivoted its focus with the acquisition of a high-potential gold asset in the United States.

A Year of Major Milestones and Strategic Financing

The cornerstone of QGold's year was the successful closing of a $11.5 million private placement financing on October 3, 2025. The offering was fully subscribed and included a 15% overallotment, with BMO Capital Markets acting as the lead agent. This influx of capital has significantly bolstered the company's treasury, providing the necessary resources to advance its dual-project strategy.

Proceeds from this financing are earmarked for several critical work streams. These include funding a Preliminary Economic Assessment (PEA), advancing permitting processes, conducting exploration activities, and covering general corporate purposes. This financial backing provides a solid runway for the company's ambitious plans.

Acquiring a Flagship Asset: The Quartz Mountain Project

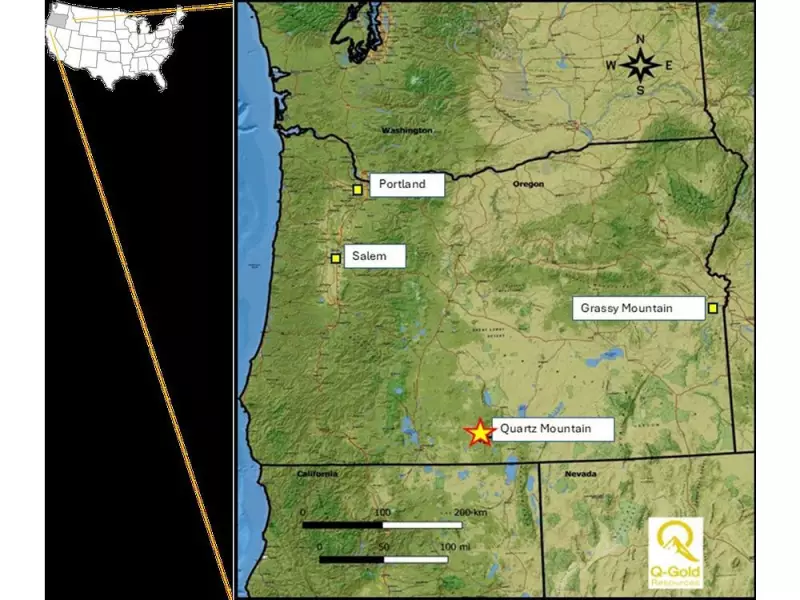

Just weeks after securing financing, QGold executed a pivotal move by purchasing the option to acquire the Quartz Mountain Gold Project from Alamos Gold Inc. The acquisition was finalized on October 22, 2025. This advanced-stage project, located in south-central Oregon's prolific gold belt, comprises two contiguous properties—Quartz Mountain and Angel's Camp—spanning approximately 4,823 acres.

To solidify the project's potential, QGold filed a new NI 43-101 technical report detailing an updated mineral resource estimate for Quartz Mountain. The company has also engaged Kappes Cassiday to commence a PEA, a crucial step in evaluating the project's economic viability. Furthermore, permitting efforts are advancing through the engagement of consultancy firm SLR International.

Strengthening Governance and Market Presence

Parallel to its operational achievements, QGold strengthened its leadership by adding two industry veterans to its board of directors. The company welcomed Scott Parsons, Vice President of Exploration at Alamos Gold, and Jamsheed Mehta, former Vice Chair at BMO Capital Markets. These appointments bring deep technical and financial expertise to guide the company's next phase.

Enhancing its visibility to U.S. investors, QGold also commenced trading on the OTCQB Venture Market under the ticker symbol "QGLDF." This move provides greater accessibility for American retail and institutional investors.

Dual-Project Strategy: Advancing Canadian Operations

While the Quartz Mountain project takes center stage, QGold has not neglected its Canadian assets. The company has initiated two drill campaigns at its Mine Centre gold project in Ontario. This ongoing work in Canada demonstrates a balanced portfolio approach, maintaining exploration momentum in a established mining jurisdiction while developing its new flagship asset in Oregon.

President and CEO Peter Tagliamonte summarized the year's achievements, stating the company is now "exceptionally well-positioned" to advance the Quartz Mountain project through economic studies and permitting in 2026. The stated goal is clear: to become Oregon's next gold producer, leveraging a strengthened balance sheet, a robust resource base, and an experienced team to navigate the path forward.