In a significant development for the global lithium supply chain, Lithium Argentina AG and Ganfeng Lithium Group have announced major progress on their joint lithium brine project in Argentina. The companies revealed the results of a comprehensive scoping study and received crucial environmental approval for the first stage of their Pozuelos-Pastos Grandes (PPG) project.

Project Overview and Partnership Structure

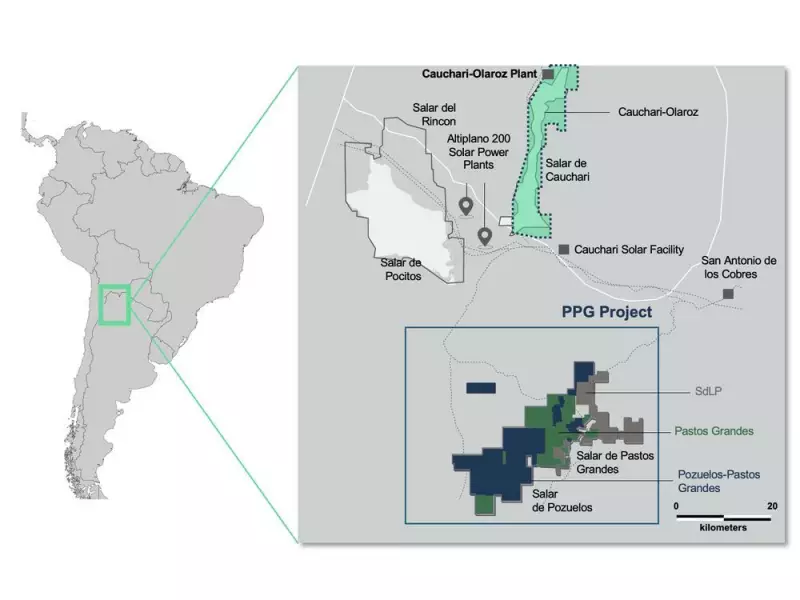

The PPG project represents a strategic consolidation of three separate projects owned by Ganfeng Lithium Group and Lithium Argentina into a single development platform. Located in the Pozuelos and Pastos Grandes basins within Argentina's Salta Province, this integrated project will see Ganfeng holding a 67% stake while Lithium Argentina maintains 33% ownership upon closing of their new joint venture agreement.

Sam Pigott, President and CEO of Lithium Argentina, emphasized the significance of this development, stating that the project builds on the success of their previous collaboration at Cauchari-Olaroz. The partnership combines Ganfeng's extensive processing expertise with Lithium Argentina's upstream experience and local operational knowledge.

Key Project Highlights and Economics

The scoping study reveals impressive metrics that position PPG as a globally significant lithium resource. The project features a scalable production platform designed to eventually reach approximately 150,000 tonnes per annum of lithium carbonate equivalent (LCE) through three sequential stages of 50,000 tpa each. With a projected 30-year operational life, PPG boasts a measured and indicated resource of 15.1 million tonnes of LCE, placing it among the largest undeveloped lithium brine resources worldwide.

From an economic perspective, the project demonstrates strong viability even in conservative market conditions. At a lithium carbonate price of $18,000 per tonne, the project shows an after-tax NPV8% of $8.1 billion and an internal rate of return of 33%. Even at a reduced price point of $12,000 per tonne, the project maintains an attractive IRR of 21%.

Environmental Approval and Technical Innovation

A crucial milestone was achieved on November 7, 2025, when the Secretariat of Mining and Energy of Salta Province issued the Environmental Impact Statement (Declaración de Impacto Ambiental) for Stage 1 of the PPG Project. This approval followed a rigorous 14-month review process that underscores the project's commitment to sustainable development practices.

The project will employ a hybrid processing approach combining traditional solar evaporation with Direct Lithium Extraction (DLE) technology. This innovative method is designed to improve operational efficiency while significantly reducing freshwater consumption, addressing key environmental concerns associated with lithium extraction from brine resources.

Financial and Development Timeline

The capital investment profile shows Stage 1 requiring approximately $1.1 billion in initial capital costs, including a 16% contingency allocation. Over the entire project lifecycle, total capital expenditure is estimated at $3.3 billion. The operating cost structure appears competitive, with cash costs projected at $5,027 per tonne and all-in sustaining costs of $5,351 per tonne over the project's duration.

Both companies are jointly advancing the financing process, considering a combination of debt financing, offtake agreements, and minority equity investments. Looking ahead, the partnership targets submitting a RIGI application in the first half of 2026, taking advantage of Argentina's investment incentive regime to support project development.

A comprehensive technical report prepared by Golder Associates in compliance with NI 43-101 and SK 1300 standards will be filed within 45 days, providing additional detailed information for investors and stakeholders. All financial figures are presented in U.S. dollars and reflect 100% project basis unless otherwise specified.