Centerra Gold Inc. has unveiled promising new economic projections for its Kemess project in British Columbia, outlining a potential restart plan with significant financial upside. The company released the results of a Preliminary Economic Assessment (PEA) on January 19, 2026, which paints an optimistic picture for the long-dormant asset.

Robust Financial Metrics and Production Profile

The PEA, which is preliminary in nature, forecasts strong economics based on long-term metal price assumptions of $3,000 per ounce of gold and $4.50 per pound of copper. The study calculates an after-tax net present value (using a 5% discount rate) of $1.1 billion and an after-tax internal rate of return of 16%.

President and CEO Paul Tomory highlighted the project's potential, noting the value of Kemess increases to approximately $2.8 billion when evaluated at current spot metal prices, due to its significant unstreamed gold and copper production. The proposed mine plan envisions an initial 15-year operational life.

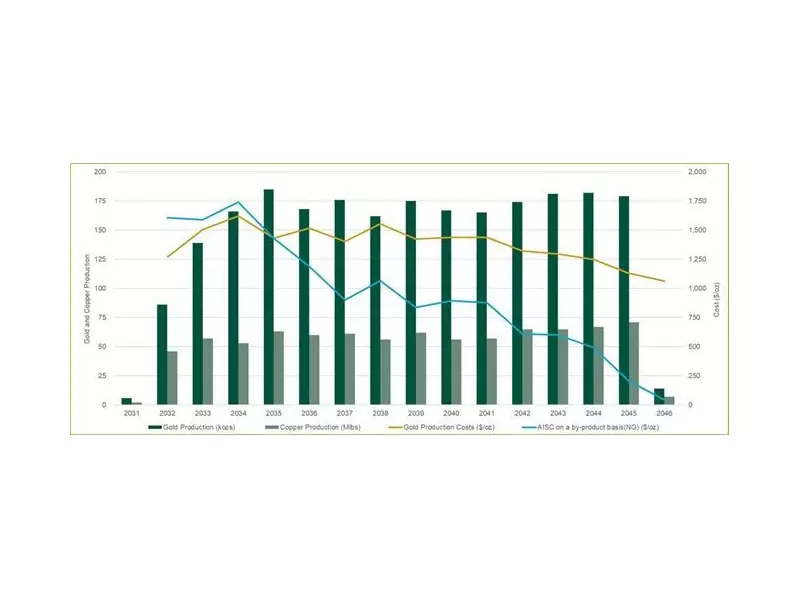

During this period, the project is expected to yield average annual production of 171,000 ounces of gold and 61 million pounds of copper. This translates to roughly 267,000 gold equivalent ounces per year. The all-in sustaining cost on a by-product basis is projected at $971 per ounce of gold.

A De-risked Development Strategy

The PEA outlines a streamlined execution plan designed to minimize risk and capitalize on existing advantages. A key component is an integrated mining strategy that combines conventional open pit operations with longhole open stoping underground mining.

This approach, along with the utilization of substantial existing infrastructure already at the site, is credited with lowering both capital requirements and overall execution risk. The staged capital investment plan further de-risks the project's development pathway.

Tomory emphasized that the study builds on a significant mineral endowment and represents a disciplined evaluation of all available geological data. This includes recent drilling and technical work in the Nugget zone and the historical Kemess South deposit.

Significant Upside and Future Steps

Notably, the PEA only incorporates resources from the Kemess Main and Kemess Underground areas, which account for just 47% of the total indicated and inferred resource tonnes identified on the property. This leaves considerable potential for future resource expansion and incorporation into subsequent studies.

The company sees Kemess as a strategic opportunity to establish a second long-life gold-copper asset in British Columbia, complementing its existing Mount Milligan operation. This would strengthen Centerra's presence in the Toodoggone region, which it describes as one of the most prospective mining jurisdictions in North America.

Exploration upside remains substantial, particularly in the deep Kemess Offset zone and along the Kemess East trend. Centerra's immediate focus is on ongoing exploration and advancing technical work, with a Pre-Feasibility Study expected in 2027. The company plans to fund this organic growth pipeline internally.

It is important to note that the PEA is preliminary and includes inferred mineral resources considered too speculative to have economic considerations applied to categorize them as reserves. There is no certainty the PEA results will be realized.