K92 Mining Delivers Exceptional Third Quarter Performance

K92 Mining Inc., a prominent mining company listed on the TSX under the symbol KNT, has announced its outstanding financial and operational results for the third quarter ending September 30, 2025. The company achieved record-breaking figures across several key financial metrics, demonstrating robust growth and operational efficiency.

Record-Breaking Financial Performance

The company reported a record net cash position of $131.2 million, contributing to a total cash and cash equivalents balance of $185.4 million. This financial strength was underpinned by record quarterly revenue of $177.5 million, representing a substantial 45% increase compared to the same period in 2024.

Net income for the quarter soared to $85.7 million, or $0.35 per share, marking an impressive 84% year-over-year growth. The company also generated a record operating cash flow of $101.8 million ($0.42 per share) before working capital adjustments, alongside a record EBITDA of $130.2 million ($0.54 per share).

Strong Operational Results and Production Metrics

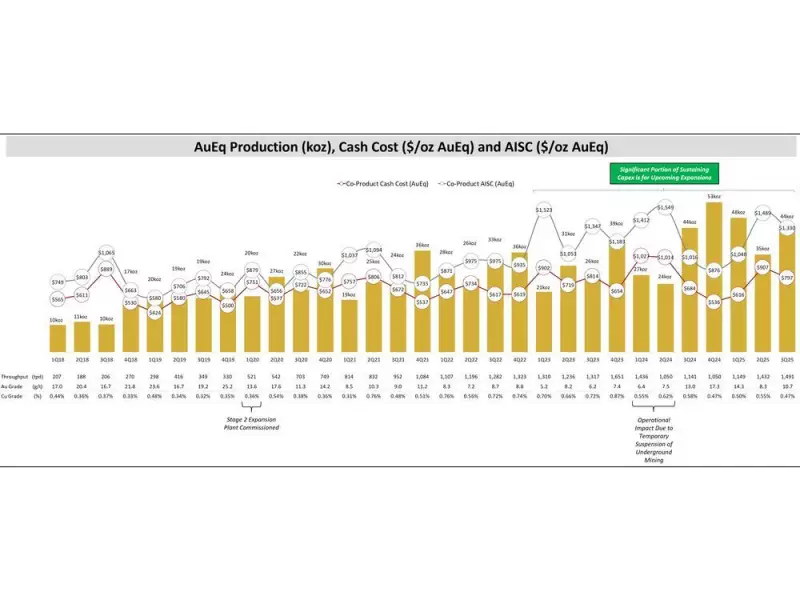

K92 maintained strong production levels during the quarter, with 44,323 ounces of gold equivalent produced, comprising 42,244 ounces of gold, 1.3 million pounds of copper, and 34,831 ounces of silver. The company processed 137,172 tonnes of ore, with head grades averaging 11.2 grams per tonne gold equivalent.

The company reported cash costs of $694 per ounce of gold on a net by-product credit basis, with all-in sustaining costs of $1,254 per ounce. Metallurgical recoveries remained strong at 95.0% for gold and 94.6% for copper, marking the sixth consecutive quarter exceeding definitive feasibility study parameters.

With over 80% of the lower end of its 2025 production guidance already achieved in the first three quarters, K92 remains on track to meet its annual target of 160,000-185,000 ounces of gold equivalent.

Strategic Expansion and Growth Initiatives

A significant milestone was achieved with the completion of the Stage 3 Expansion Process Plant, which was delivered under budget. The 1.2 million tonnes-per-annum facility began commissioning in September 2025, with first commercial grade concentrate produced in mid-October. The plant was officially inaugurated on October 16, 2025, in a ceremony attended by Papua New Guinea's Prime Minister, James Marape, and other dignitaries.

The company has committed or spent 90% of the Stage 3 Expansion growth capital, remaining on budget. Several key underground construction projects were completed during the quarter, including the Material Pass, Phase 2 Ventilation Upgrade, and Surface Tele-Remote Loader System.

Exploration activities also showed promising results, with the Arakompa project drill program expanding the bulk tonnage zone over 1,100 metres of strike length. K92 plans to deliver a maiden mineral resource estimate for Arakompa in mid-2026.

John Lewins, K92 Chief Executive Officer and Director, commented on the quarter's success, highlighting the company's achievement of multiple financial records and the advancement of key projects that position K92 for continued success in both the near and long term.