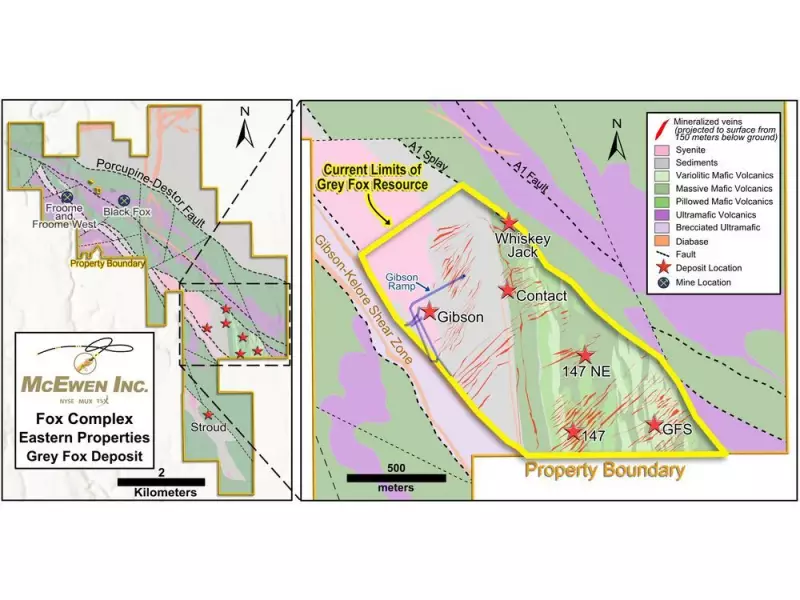

McEwen Inc. has announced a substantial boost to the mineral inventory at its Grey Fox gold project in northeastern Ontario, marking a significant step forward for the company's growth strategy in the prolific Timmins camp.

Resource Estimate Shows Robust Growth

The company's Year-End 2025 Mineral Resource Estimate for the Grey Fox Project, part of the larger Fox Complex, now stands at a combined 1.9 million ounces of gold in the Indicated category and 436,000 ounces in the Inferred category. This represents a notable 23% increase in the Indicated resource compared to the previous year-end estimate from 2024.

The updated numbers, calculated using a gold price of US$3,000 per ounce, are based on 19.47 million tonnes grading 3.02 grams per tonne (gpt) gold for the Indicated resource and 5.10 million tonnes grading 2.66 gpt gold for the Inferred resource.

McEwen sees clear potential for further resource expansion. Key avenues for growth include integrating the recently acquired adjacent Stroud Property, which hosts a historical resource of approximately 270,000 gold ounces, incorporating new drill results received after the estimate's cut-off date, and through ongoing optimization of mine and plant designs.

Strategic Shift to Combined Mining Approach

A pivotal shift in the project's development strategy is now underway. While Grey Fox was initially conceived as a primarily underground operation, the company is now evaluating a balanced approach that incorporates both underground and open pit mining methods.

This phased development plan, which will be detailed in an upcoming Pre-Feasibility Study (PFS), is designed to maximize the project's long-term value. A key advantage is the potential for early access to high-return gold ounces through the existing ramp and underground infrastructure, accelerating cash flow.

The highly anticipated PFS is scheduled for publication in the second quarter of 2026. The study will provide a comprehensive blueprint for developing Grey Fox into a cornerstone asset, supporting McEwen's ambitious goal of doubling its overall production by the year 2030.

Focus on High-Potential Zones and Future Expansion

The resource update highlights two specific underground zones with excellent potential for near-term, high-margin production:

The Gibson Zone, located conveniently close to existing underground infrastructure, contains Indicated Resources of 393,000 gold ounces and Inferred Resources of 297,000 ounces.

The Whiskey Jack Zone, though smaller in tonnage, boasts the project's highest grades, with Indicated Resources of 122,000 ounces at a grade of 5.16 gpt gold.

Concurrently, the PFS will seriously evaluate open pit mining scenarios. The current resource and study only consider pit-constrained mineralization within McEwen's existing mineral claims. However, the company notes that future land agreements with adjacent owners could allow for a pit layback, potentially unlocking significant additional open pit resources in subsequent updates.

With a strengthened resource base and a clear path to a definitive study in 2026, the Grey Fox Project is positioning itself as a major contributor to the next chapter of gold mining in the historic Timmins district.