Toronto-based G2 Goldfields Inc. has released the highly anticipated results of its first Preliminary Economic Assessment for the high-grade Oko Gold Project located in Guyana, South America. The announcement, made on December 18, 2025, reveals a project with compelling economics and significant scale, positioning it as a major potential gold producer.

Robust Economics and Production Profile

The PEA outlines a 14-year life of mine operation combining both open pit and underground mining methods. The project is forecast to produce a total of 3.2 million ounces of gold over its lifespan. From years two through eleven, the operation is projected to yield an impressive average of 281,000 ounces of gold annually.

Financially, the project demonstrates strong returns. Using a base case gold price of $3,000 per ounce, the after-tax Net Present Value discounted at 5% is estimated at $2.6 billion, with an Internal Rate of Return of 39%. The capital outlay is expected to be recovered in approximately 2.6 years. At a higher gold price assumption of $4,000 per ounce, the economics improve dramatically to an after-tax NPV5% of $4.2 billion and an IRR of 54%.

Resource Base and Operational Details

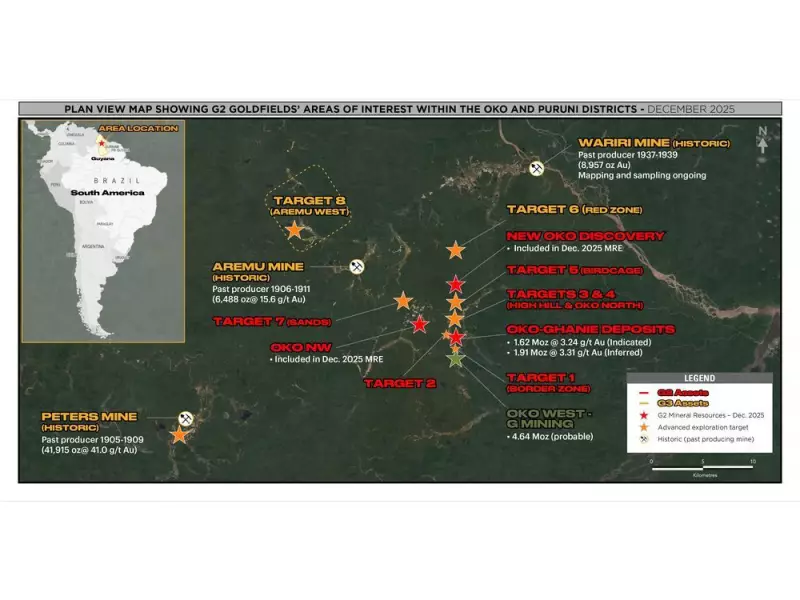

The study is underpinned by an updated Mineral Resource Estimate effective November 20, 2025. The resource includes 1.6 million ounces of gold in the Indicated category at a grade of 3.24 grams per tonne, and a further 1.9 million ounces in the Inferred category at 3.31 grams per tonne. This estimate incorporates six months of new drilling data, highlighting the project's continued growth potential.

The planned operation envisions a conventional processing plant with a capacity of 10,000 tonnes per day. The circuit will include comminution, gravity concentration, and carbon-in-leach recovery. The projected all-in sustaining cost is $1,191 per ounce over the full mine life, improving to $1,137 per ounce during the peak production years from two to eleven.

Management Commentary and Next Steps

Daniel Noone, CEO of G2 Goldfields, expressed strong confidence in the project's outlook. He stated that the PEA firmly places the Oko Project among the most attractive gold development projects globally, citing its high-grade resource, significant production profile, and location in the mining-friendly jurisdiction of Guyana.

Noone also emphasized the district-scale exploration potential surrounding the known deposits, with multiple drill programs active on adjacent targets. The company has announced its intention to aggressively advance the Oko Project toward a feasibility study and eventual construction.

A full technical report prepared in accordance with National Instrument 43-101 standards will be filed on the company's website and its SEDAR+ profile within 45 days of the December 18th news release.