Vancouver-based First Atlantic Nickel Corp. has successfully completed a significant non-brokered private placement financing, securing $2,619,316 in gross proceeds. The financing, which closed on December 23, 2025, was structured as a no-warrant offering of flow-through shares.

Strategic Investor Maintains Significant Stake

A key development accompanying the financing was the action of a strategic investor. Under the terms of an existing Investor Rights Agreement, the investor exercised its top-up right. This provision allows the investor to maintain its ownership position in First Atlantic Nickel at up to 9.99% following the dilution from the new share issuance.

The offering consisted of two tranches of flow-through shares, issued under the provisions of the Income Tax Act (Canada). The company issued 3,201,220 charity flow-through shares (CFT Shares) at a price of $0.2432 per share. It also issued 8,765,618 standard flow-through shares (FT Shares) at $0.21 per share.

Funding Directed to Flagship Newfoundland Project

The capital raised is earmarked exclusively for the company's Pipestone XL Nickel Alloy Project, located in Newfoundland. The funds will be used to incur eligible Canadian exploration expenses, qualifying as flow-through mining expenditures. The company has committed to renouncing these qualifying expenditures to subscribers, effective December 31, 2025, with all exploration work required to be completed by December 31, 2026.

First Atlantic Nickel plans an aggressive exploration program. The proceeds will enable the company to immediately advance drilling at the known RPM Zone, test newly identified targets across the expansive project area, and expand its metallurgical recovery and processing studies.

The Pipestone XL Project: A Unique Nickel Opportunity

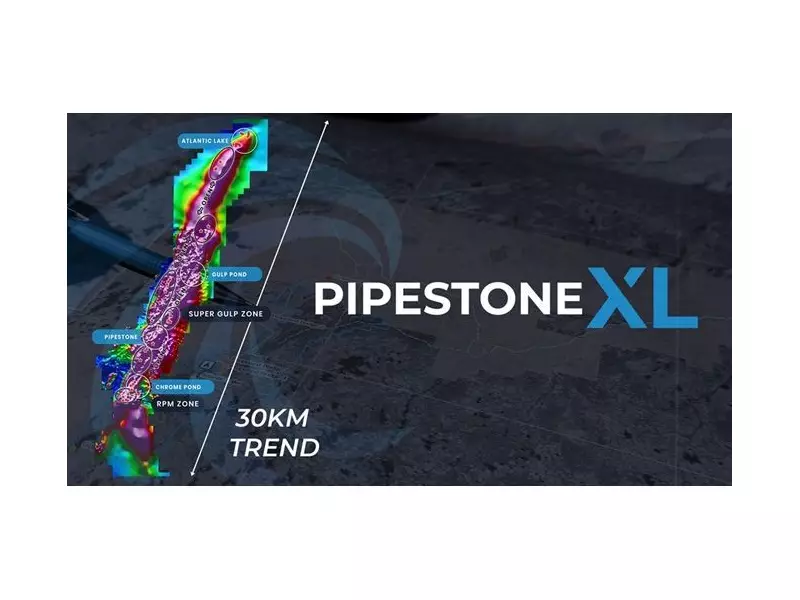

The Pipestone XL Project is a substantial land package, covering the entire 30-kilometer Pipestone Ophiolite Complex in central Newfoundland. First Atlantic Nickel holds 100% control of this belt of serpentinized ultramafic rocks, which are enriched in nickel and chromium.

The project's primary target is awaruite (Ni₃Fe), a naturally occurring nickel-iron-cobalt alloy with an approximate 75% nickel content. This mineral is found across multiple discovery zones on the property, including the RPM Zone, Super Gulp, Atlantic Lake, and Chrome Pond.

Awaruite presents distinct advantages over conventional nickel sulfide deposits. Its sulfur-free composition and strong magnetic properties allow for concentration using simple magnetic separation, bypassing the need for energy-intensive smelting. This process eliminates the risk of acid mine drainage and reduces reliance on overseas processing infrastructure. The project is accessible year-round by road and is close to sources of clean hydroelectric power.

The company positions the project as a potential source of secure, low-carbon nickel for critical North American supply chains, serving the stainless steel, electric vehicle, aerospace, and defense industries.

In a recent report titled "From Rocks to Power," the Battery Metals Association of Canada highlighted the potential of awaruite, noting that simple beneficiation could yield a 60% nickel concentrate ready for battery cathode production. The association suggested such a process could bypass early pyrometallurgy stages and position a site among the lowest carbon-intensive nickel producers globally.

For further information, the company has directed inquiries to Rob Guzman of Investor Relations.