Aya Gold & Silver Inc. has released outstanding results from its Preliminary Economic Assessment (PEA) for the Boumadine project in Morocco, revealing what could be one of the most compelling precious metals developments in the sector.

The numbers speak for themselves: The project demonstrates robust economics with an impressive 31% after-tax internal rate of return and a net present value of $412 million at a 5% discount rate. Even more remarkable is the projected capital payback period of just 2.3 years, highlighting the project's exceptional efficiency and low-risk profile.

Project Highlights and Production Profile

Boumadine is positioned to become a significant precious metals producer with projected average annual production of 134,000 gold equivalent ounces over a 10-year mine life. The project benefits from a capital-efficient design requiring just $287 million in initial capital expenditure.

Key operational metrics include:

- Life of mine all-in sustaining cost of $864 per gold equivalent ounce

- Total production of 1.34 million gold equivalent ounces

- Strong free cash flow generation potential

- Existing infrastructure reducing development risks

Strategic Advantages and Future Potential

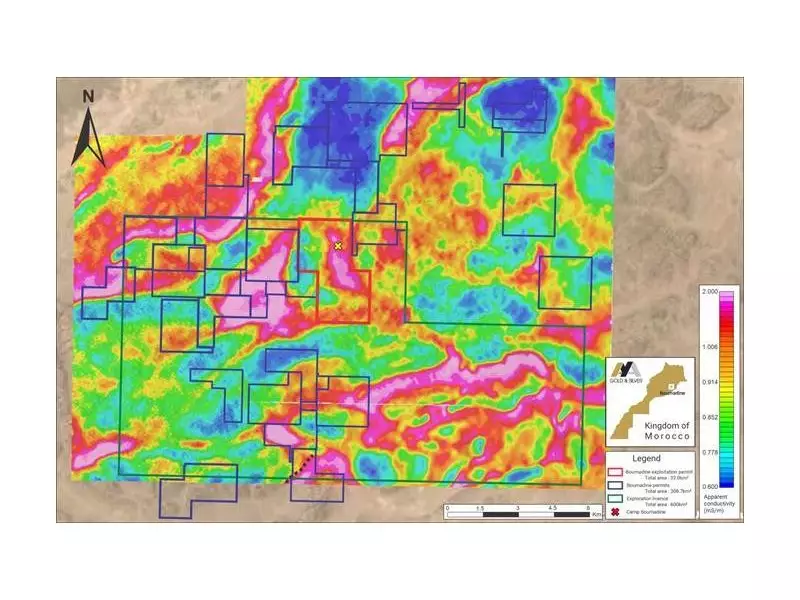

What makes Boumadine particularly attractive is its strategic location in Morocco, a mining-friendly jurisdiction with established infrastructure. The project builds on Aya's existing operational expertise from its Zgounder Silver Mine, creating potential synergies and operational efficiencies.

The PEA results significantly de-risk the project while highlighting substantial exploration upside. With only 4.5 kilometers of the 12-kilometer mineralized trend tested so far, Boumadine offers excellent potential for resource expansion and mine life extension.

President and CEO Benoit La Salle expressed strong confidence in the project, noting that the results validate Boumadine as a high-return, capital-efficient asset that aligns perfectly with Aya's growth strategy in precious metals.

Investment Implications

For investors seeking exposure to precious metals, Boumadine represents a compelling opportunity. The combination of high returns, rapid payback, and exploration upside in a stable jurisdiction positions Aya Gold & Silver as a company to watch in the mining sector.

The project's economics compare favorably with peer developments, suggesting strong potential for value creation as Boumadine advances through further feasibility studies and toward production.