Vancouver-based Aldebaran Resources has unveiled a highly promising preliminary economic assessment (PEA) for its Altar copper-gold project in Argentina, painting a picture of a long-life mining operation with substantial financial upside.

Robust Financial Metrics

The newly released PEA demonstrates compelling economics, with an after-tax net present value (NPV) of US$2 billion using an 8% discount rate. The project also boasts an impressive internal rate of return (IRR) of 20.5%, indicating strong potential profitability for investors.

Exceptional Mine Longevity

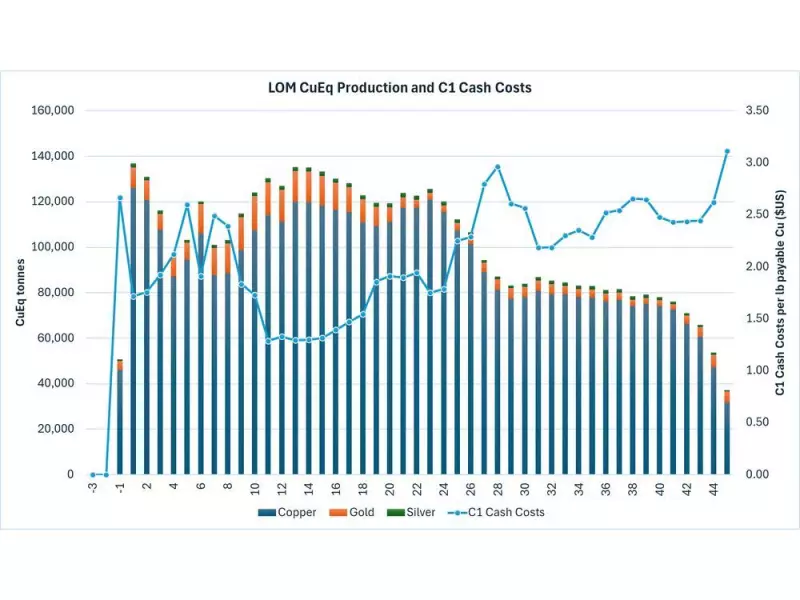

One of the standout features of the Altar Project is its remarkable 48-year mine life. This extended operational timeline positions Altar as a significant long-term player in the global copper market, capable of delivering sustained production for nearly half a century.

Production Projections

The project is expected to yield substantial metal production throughout its lifecycle. The PEA outlines average annual production of 147,000 tonnes of copper equivalent during the first 13 years of operation, with life-of-mine production estimated at 5.3 million tonnes of copper equivalent.

Strategic Positioning

Located in San Juan Province, Argentina, the Altar Project benefits from existing infrastructure and mining-friendly jurisdiction. The positive PEA results mark a significant milestone for Aldebaran Resources as the company advances one of the most promising copper development projects in South America.

This comprehensive assessment underscores the project's potential to become a major contributor to global copper supply while delivering substantial value to shareholders and local stakeholders alike.