Alamos Gold Charts Ambitious Growth Trajectory with New Three-Year Plan

In a significant announcement from Toronto, Alamos Gold Inc. has laid out a comprehensive three-year operational guidance framework, projecting a substantial 46% growth in gold production by the year 2028. This strategic roadmap is coupled with an expectation of markedly lower all-in sustaining costs, signaling a robust period of expansion and efficiency for the Canadian mining firm.

Detailed Production and Cost Projections

The company provided specific targets for the coming years. For 2026, total gold production is forecasted to range between 570,000 and 650,000 ounces. This is expected to climb to 650,000–730,000 ounces in 2027, and further increase to 755,000–835,000 ounces by 2028. Concurrently, all-in sustaining costs are projected to decline from $1,500–$1,600 per ounce in 2026 to $1,200–$1,300 per ounce in 2028, representing an approximate 18% reduction from 2025 levels.

John A. McCluskey, President and Chief Executive Officer of Alamos Gold, addressed the company's recent performance and future outlook. "Our operational performance over the past year was not up to our standards and not reflective of our long-term track record," McCluskey stated. "We expect to deliver a stronger performance in 2026, particularly into the second half of the year as production ramps up and costs decrease with the completion of the shaft expansion at Island Gold."

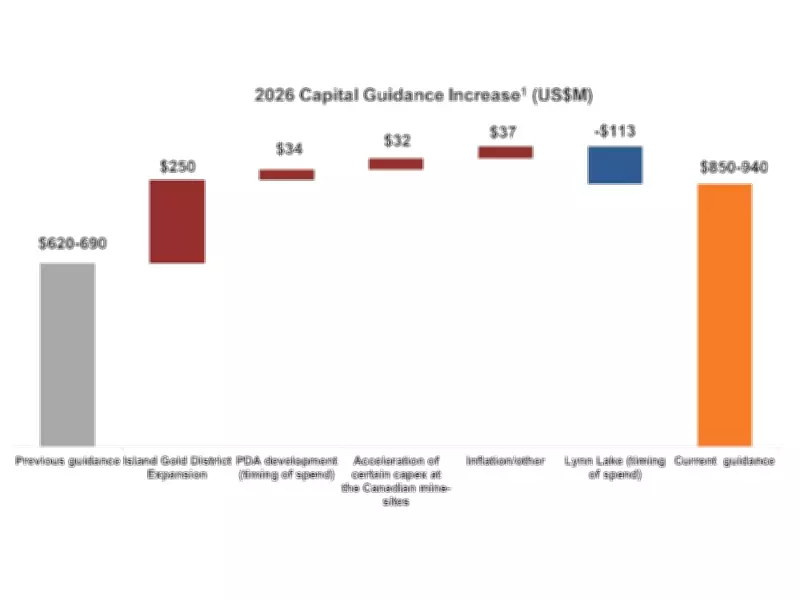

Capital Expenditure and Long-Term Vision

The guidance outlines a substantial capital investment plan, with total capital expenditures for 2026 estimated between $850 million and $940 million. This figure is anticipated to decrease by approximately 28% by 2028 as major expansion projects near completion. The capital plan is heavily focused on two key development projects:

- Island Gold District Expansion: A multi-phased expansion aimed at increasing milling capacity to 20,000 tonnes per day by 2028.

- Lynn Lake Project: A new development in Manitoba, with initial production targeted for 2029 and an updated total initial capital cost of $934 million.

McCluskey emphasized the strength of the company's position, noting, "We expect to deliver 46% production growth by 2028, and nearly 20% decrease in AISC. This trend is expected to continue with production expected to increase to one million ounces annually by 2030 driven by the multi-phased expansion of the Island Gold District and start up of Lynn Lake." He highlighted that all this growth is situated within Canada, is lower cost, and can be funded internally while generating increasing free cash flow.

Financial Performance and Shareholder Returns

The company reported free cash flow of approximately $350 million in 2025. This is projected to rise to over $500 million in 2026 and exceed $1 billion by 2028, driven by the anticipated production growth and declining costs. This robust financial outlook is expected to support enhanced returns to shareholders.

In 2025, Alamos Gold returned a record $81 million to shareholders through dividends and share buybacks, which included the repurchase of 1.3 million shares. The company anticipates that growing free cash flow in 2027 and beyond will allow for increasing shareholder returns.

Addressing Challenges and Future Potential

The updated guidance also addresses several operational factors. The capital cost for the Lynn Lake project has been revised upward from earlier estimates, reflecting a larger mill design, industry-wide inflation, and construction delays due to wildfires in Northern Manitoba in 2025. Furthermore, the company has increased its exploration budget to a record $97 million for 2026, a 35% increase from 2025, to support ongoing success across its asset base.

This detailed three-year plan positions Alamos Gold for a period of significant transformation, aiming to nearly double its 2025 production by 2030 through disciplined capital allocation and project execution entirely within its Canadian operations.