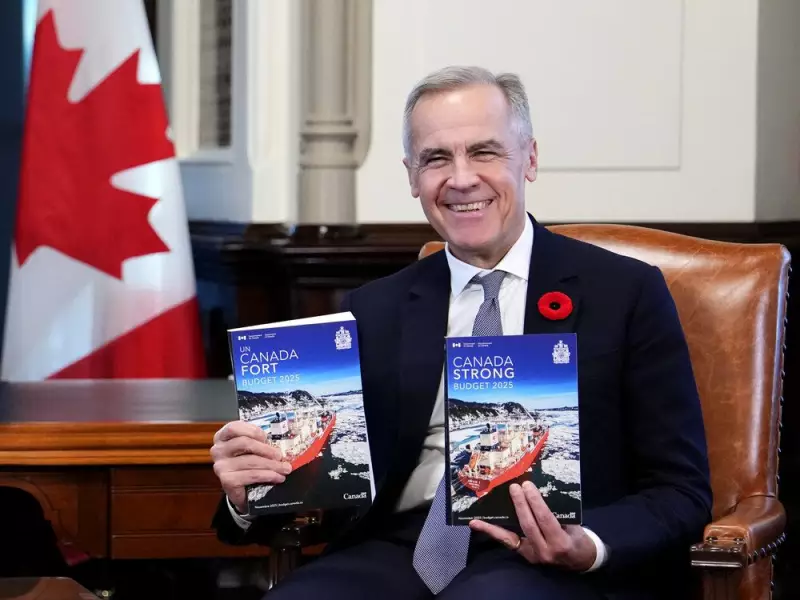

Finance Minister Chrystia Freeland has unveiled Canada's 2025 federal budget, presenting a financial blueprint that's generating strong reactions across the economic spectrum. Dubbed "Fairness for Every Generation," this budget represents one of the most significant fiscal shifts in recent memory, with profound implications for investors, homeowners, and everyday Canadians.

The Good News: Housing Affordability Takes Center Stage

For younger Canadians struggling with housing costs, the budget offers several promising initiatives. The extension of the mortgage amortization period to 30 years for first-time buyers purchasing newly built homes could be a game-changer, reducing monthly payments substantially. Additionally, the increase in the Home Buyers' Plan withdrawal limit to $60,000 provides much-needed flexibility for those tapping into retirement savings to enter the housing market.

Other positive developments include:

- Enhanced Canadian Renters' Bill of Rights to protect tenants

- Accelerated purpose-built rental construction through tax incentives

- Expanded supports for low-income seniors and students

- New funding for Indigenous housing initiatives

The Bad News: Tax Increases Hit Wealthier Canadians

The budget's most controversial element involves significant tax changes that will primarily affect higher-income individuals and corporations. The capital gains inclusion rate increase from 50% to 66.7% for gains over $250,000 represents the most substantial tax hike in decades.

"This isn't just tinkering around the edges—it's a fundamental shift in Canada's tax philosophy," notes one economic analyst. The changes are expected to generate nearly $20 billion in additional revenue over the coming years, but critics warn they could discourage investment and entrepreneurship.

The Ugly Reality: Soaring Deficits and Economic Uncertainty

Perhaps the most concerning aspect of Budget 2025 is the staggering deficit projection. With $52.9 billion in red ink forecast for this year alone, Canada's debt-to-GDP ratio continues to climb, raising questions about long-term fiscal sustainability.

Key concerns economists are highlighting:

- No clear path to balanced budgets in the foreseeable future

- Potential negative impact on Canada's credit rating

- Limited fiscal flexibility for future economic crises

- Growing debt servicing costs that could crowd out other priorities

What This Means for Your Wallet

For middle-class Canadians, the budget presents a mixed bag. While housing measures offer some relief, broader economic impacts could affect job creation and investment returns. Small business owners face additional compliance burdens, while professionals with incorporated practices will see their tax advantages diminished.

The budget's success will ultimately depend on whether the promised investments in housing and social programs deliver tangible benefits without stifling the economic growth needed to pay for them. As one business leader summarized: "We're betting the house on housing, and the stakes couldn't be higher."