As the holiday season approaches, the investment professionals at Mawer Investment Management Ltd. have once again delivered their unique annual perspective. For readers of the Financial Post, the firm has released its 2025 year-end review, not in a dry report, but in the form of a reflective and often witty poem.

A Year of 'T's: Tariffs and Taylor Swift

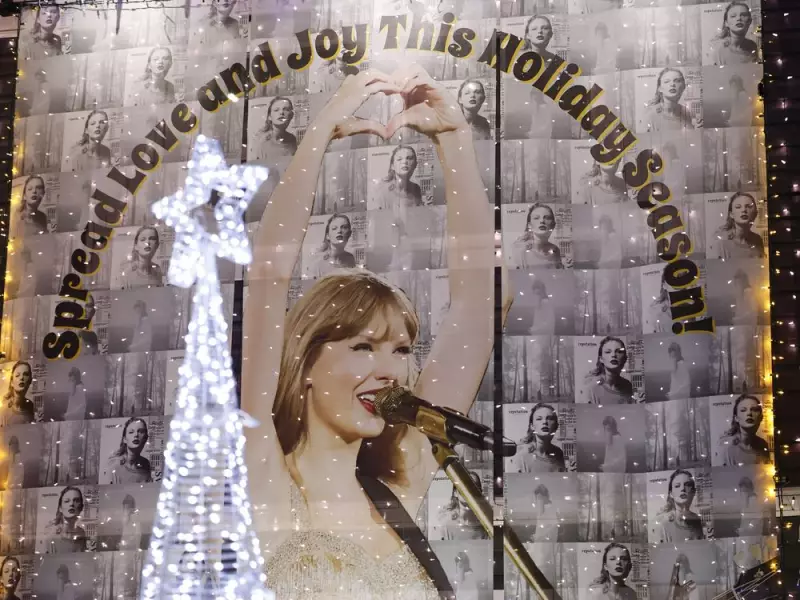

The poem, published on December 22, 2025, opens by setting the scene in the week before Christmas. It immediately highlights the dominant themes of the year, which all curiously began with the letter 'T'. While tariffs and trade battles created a cloud of economic uncertainty, another 'T' captured the public's imagination: Taylor Swift. The poem notes her significant cultural and economic influence, even suggesting she 'rose GDP'.

This playful observation sits alongside more serious concerns about renewed trade tensions. The poem references 'Tariff Man's back!' and depicts Canadians bracing for impact, with key industries like steel and lumber caught in the crossfire. Despite the loud headlines and fears of soaring prices, the poem points out that the market's reaction was surprisingly muted. Businesses adapted their supply chains, and the anticipated consumer price surge failed to materialize as dramatically as predicted.

The AI Frenzy and Market Concentration

A major section of Mawer's poetic analysis is devoted to the relentless focus on artificial intelligence. The poem states that since the debut of ChatGPT, AI's star has 'burned bright,' driving a lion's share of market returns. This boom has led to immense capital expenditures, with billions flowing into data centres, semiconductors, and servers.

However, the poem injects a note of caution. It questions the real return on investment (ROI) from this spending spree, comparing the AI race to a character from 'Stranger Things.' It warns that while optimism is contagious, leverage and bubbles can lead to a painful twist. The proliferation of AI 'co-pilots' in workplaces is noted, alongside the persistent issue of AI 'hallucinations'—one bot even allegedly congratulated a user on being named 'Supreme Ruler.'

Gold, Bitcoin, and a Call for 'Boring' Discipline

The poem also touches on other asset classes. Gold producers enjoyed a bullion-fuelled ride, driven by geopolitical unrest and central bank buying. In contrast, bitcoin is described as still finding its place, characterized by legendary volatility and speculative, lottery-like returns.

Throughout its verses, Mawer's poem returns to a core investment philosophy. It emphasizes that for every wild headline, the enduring lessons are patience and prudence. The firm advises a defensive, disciplined approach, explicitly endorsing a 'boring' strategy as the wisest course for the year. It points to rising debt levels, steep yield curves, and compressed credit spreads as reasons for caution and capital preservation.

The poem concludes by extending season's greetings, wishing for a calm holiday and a prosperous new year, presumably achieved through that same steady, process-driven approach that defines Mawer's investment style.