Abaxx Digital Title Technology Achieves Breakthrough in Collateral Mobilization

Abaxx Technologies Inc., a prominent financial software and market infrastructure company based in Toronto, has announced the successful completion of two groundbreaking pilot transactions utilizing its innovative ID++ Digital Title technology. These commercial pilots represent a significant advancement in addressing long-standing inefficiencies within the post-trade movement of collateral across global financial markets.

Addressing Multi-Trillion Dollar Market Inefficiencies

The two pilot transactions specifically targeted the transfer of ownership for physical gold and money market fund shares, achieving T+0 finality that addresses critical gaps in a US$1.4 trillion margin market and a US$2.5 trillion trade-finance market. While blockchain tokenization initiatives have highlighted the potential for increasing collateral velocity, many institutional applications have remained constrained by legal and regulatory uncertainties surrounding digital token formats.

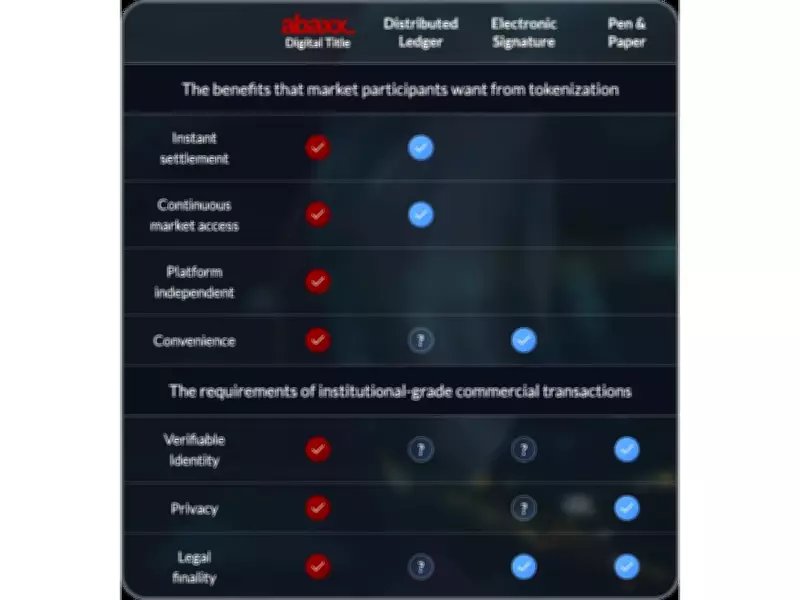

Abaxx's proprietary Digital Title technology bridges this gap by converting physical commodities and regulated securities into legally enforceable, transaction-ready collateral within existing legal and regulatory frameworks. This approach maintains the identity controls, cross-jurisdictional legal certainty, and transaction confidentiality that form the foundation of today's regulated markets.

Technical Innovation and Legal Framework

Unlike existing tokenization models that depend on parallel ledgers or bearer instruments tied to offline identity whitelists, Abaxx Digital Title represents a fully contained instrument capable of transferring ownership under internationally recognized standards. The technology aligns with UNCITRAL's Model Law on Electronic Transferable Records (MLETR), positioning Abaxx to uniquely enable collateral mobility at an institutional scale.

The company's market infrastructure innovation demonstrates that identity-anchored digital instruments can deliver both T+0 finality and capital efficiency while simultaneously reducing regulatory risks and cross-jurisdictional ownership uncertainties inherent in traditional blockchain tokenization approaches.

Pilot Transaction Details and Results

The first pilot involved a gold-backed Digital Title transaction between an investment firm and a regulated commodity lender. This transaction enabled futures-margin financing through repo-financed custodial gold at Abaxx Spot, effectively converting vaulted inventory into transaction-ready digital collateral within regulated market infrastructure.

The second pilot utilized money market fund shares as collateral, with evidence of legal title to principal value transferring on margin call while the income yield continued to accrue to the holder. This structure provides a superior and more flexible yield arrangement compared to stablecoin claims against reserves.

Together, these pilots demonstrated a legally enforceable mechanism for direct ownership transfer and T+0 collateral mobilization across both physical commodities and regulated securities. This addresses a core institutional constraint in posting margin, financing, and working-capital deployment that has persisted in global financial markets.

Future Implementation and Commercial Strategy

Following the successful completion of these initial pilots, Abaxx is actively pursuing integration of its Digital Title framework into the company's Singapore-regulated futures and clearing ecosystem, subject to meeting all regulatory requirements. To accelerate commercial adoption of this infrastructure, Abaxx is engaging with a coalition of Futures Commission Merchants (FCMs), prime brokers, and asset managers to align operational workflows.

The company is concurrently finalizing a hybrid monetization framework designed to capture value through recurring Software-as-a-Service (SaaS) fees for Console access, combined with transaction-based pricing and basis-point participation in assets on network (AoN). This strategic approach positions Abaxx to capitalize on the demonstrated capabilities of its Digital Title technology while addressing substantial market inefficiencies in collateral mobilization.