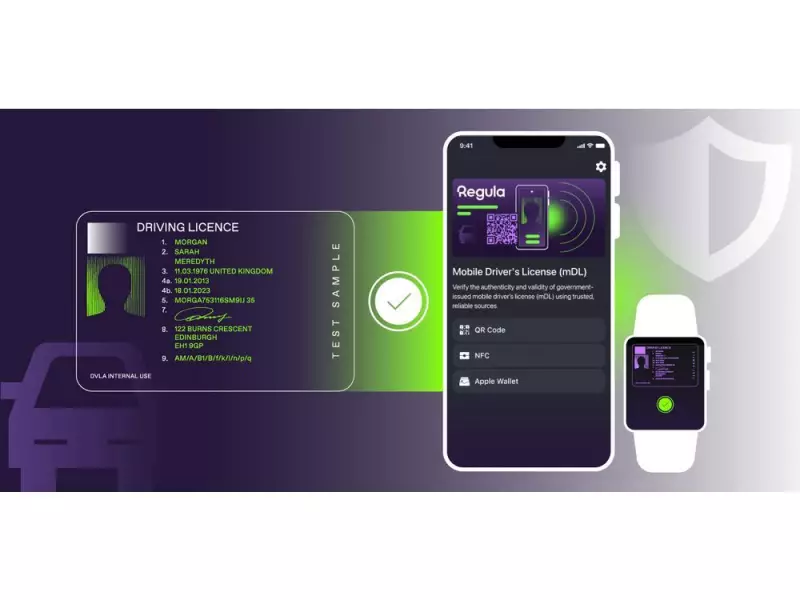

Regula Enhances Digital Identity Verification with Mobile Driver's License Support

As digital credentials increasingly replace physical identification documents, the verification process has emerged as the critical trust bottleneck in identity management. Organizations worldwide now face the challenge of authenticating digital IDs securely, consistently, and at scale. In response to this growing need, Regula, a global developer of identity verification solutions and forensic devices, has significantly expanded its Document Reader SDK to include comprehensive support for mobile driver's licenses (mDLs).

The Rise of Mobile Driver's Licenses

From Apple Wallet implementations in the United States to European Union-wide digital license standards and government applications in the United Arab Emirates, mobile driver's licenses are rapidly becoming integral to everyday identity verification processes. It's important to note that despite the name, an mDL represents more than just driving privileges. These standardized digital identity credentials can be utilized across numerous scenarios beyond transportation, including access control systems, customer onboarding procedures, and various regulated verification processes.

Addressing Verification Challenges

As adoption of mobile driver's licenses accelerates, organizations require tools that can authenticate digital credentials with the same reliability as physical identification documents, while simultaneously reducing friction and minimizing data exposure risks. Regula's enhanced solution directly addresses these challenges by providing robust verification capabilities that maintain security without compromising user experience.

Built on Global Standards for Real-World Application

The mDL verification functionality within Regula's Document Reader SDK is built upon the ISO/IEC 18013-5 standard, which serves as the globally recognized framework for mobile driver's licenses. This standards-based approach ensures interoperability across different digital wallets, jurisdictions, and devices, significantly reducing the risk of fragmented implementations, proprietary lock-in scenarios, and unverifiable credentials.

The enhanced SDK supports multiple engagement methods, including QR code scanning and Near Field Communication (NFC) technology, while also enabling credential retrieval through Bluetooth and NFC connections. This versatility allows organizations to adapt verification workflows for both on-site and remote identity checks across diverse operational environments.

Practical Applications Across Industries

Regula's expanded verification capabilities find practical application in numerous sectors and scenarios:

- Travel and Border Security: Airport checkpoints and border crossings can implement streamlined verification processes

- Financial Services: Banks and financial institutions can enhance customer onboarding procedures

- Access Control: Organizations managing secure facilities can implement more sophisticated entry protocols

- Retail and Digital Services: Age verification processes can be accelerated while maintaining privacy protections

Advantages Over Traditional Identification Methods

By supporting mDL verification, Regula helps organizations overcome significant limitations associated with traditional physical identification documents. These advantages include reduced risks of document loss or theft, decreased vulnerability to forgery attempts, and minimized disclosure of personal data through selective information sharing capabilities.

"Mobile driver's licenses represent a substantial advancement in the evolution of digital identity systems," explains Ihar Kliashchou, Chief Technology Officer at Regula. "Unlike conventional physical IDs, mobile driver's licenses enable selective disclosure, allowing individuals to share only the specific data required for particular interactions. By implementing mDL verification support, Regula empowers organizations to significantly reduce data exposure while maintaining high assurance levels in their identity verification processes."

About Regula's Identity Verification Solutions

Regula stands as a global developer of forensic devices and comprehensive identity verification solutions. Leveraging more than three decades of experience in forensic research and maintaining the world's most extensive library of document templates, the company creates breakthrough technologies for both document and biometric verification. Regula's hardware and software solutions currently support over 1,000 organizations and 80 border control authorities worldwide, enabling them to deliver exceptional client service without compromising safety, security, or operational speed. The company's technological leadership has been recognized through inclusion in the 2025 Gartner Magic Quadrant for Identity Verification.