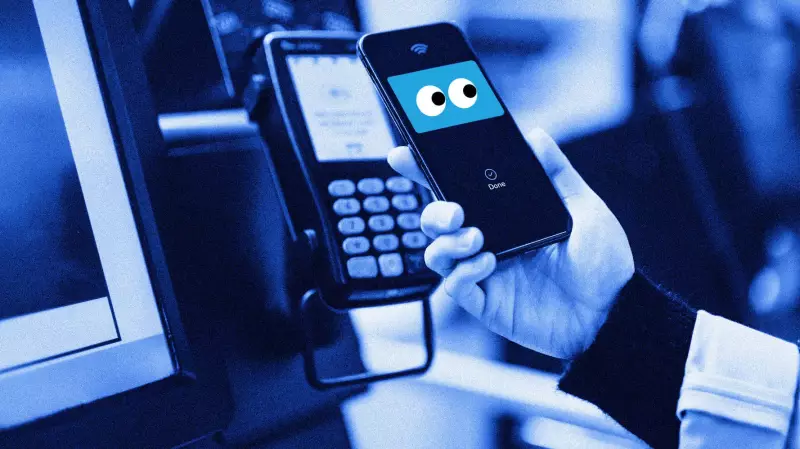

A sophisticated new digital scam called 'Ghost Tapping' is sweeping across Canada, leaving victims with drained bank accounts and financial devastation. This clever manipulation technique bypasses traditional security measures, making it one of the most dangerous financial threats Canadians face today.

What Exactly is Ghost Tapping?

Ghost tapping operates through a disturbing combination of psychological manipulation and technical deception. Scammers initiate contact via phone, posing as legitimate bank representatives or government officials. They convince victims to download remote access software under the guise of 'security updates' or 'fraud protection.'

Once installed, the fraudsters gain complete control over the victim's device while maintaining constant voice contact. The critical deception occurs when they instruct users to place their phones face down, preventing them from seeing the unauthorized transactions being processed in real-time.

How the Scam Unfolds

The ghost tapping process follows a carefully orchestrated sequence:

- The Initial Contact: Victims receive convincing calls from numbers spoofed to appear as legitimate financial institutions

- Authority Impersonation: Scammers use official-sounding language and reference real security protocols to build trust

- Software Installation: Victims are guided to download remote access applications like AnyDesk or TeamViewer

- The Ghost Tapping Moment: Phones are turned screen-down while scammers initiate unauthorized transfers

- The Disappearance: Once funds are transferred, the scammers vanish, leaving victims to discover the damage

Why This Scam is Particularly Dangerous

Ghost tapping represents an evolution in digital fraud for several concerning reasons:

- Bypasses biometric security by using already-authenticated sessions

- Exploits trust in voice communication while hands perform unauthorized actions

- Uses legitimate financial apps rather than suspicious third-party platforms

- Leaves minimal digital trail compared to traditional phishing attacks

Protecting Yourself from Ghost Tapping

Canadian financial security experts recommend these essential protective measures:

Immediate Actions

Never download remote access software at the request of an unsolicited caller. Legitimate financial institutions will never ask you to install such programs for security purposes.

Verify independently. If you receive a suspicious call, hang up and contact your bank directly using the official number from their website or your bank card.

Long-term Security Practices

Enable multi-factor authentication on all financial accounts and maintain updated security software on all devices. Regularly monitor account activity and set up transaction alerts for unusual activity.

What to Do If You've Been Targeted

If you suspect you've encountered a ghost tapping attempt or have fallen victim:

- Immediately disconnect your device from the internet

- Contact your financial institution to freeze accounts

- Report the incident to the Canadian Anti-Fraud Centre

- File a report with local law enforcement

- Scan your devices for malware and change all passwords

As digital banking becomes increasingly integrated into Canadian daily life, awareness and vigilance remain our strongest defenses against evolving threats like ghost tapping. By understanding these sophisticated scams, Canadians can better protect their hard-earned money from digital predators.