Nvidia Corp. has delivered a surprisingly strong revenue forecast that is pushing back against growing concerns about an artificial intelligence market bubble, sending ripples of relief across the global technology sector.

Robust Outlook Defies Expectations

The world's most valuable chipmaker expects sales to reach approximately US$65 billion in the January quarter – roughly US$3 billion more than analysts had predicted. The company also indicated that a half-trillion-dollar revenue stream anticipated in coming quarters might actually exceed initial projections.

This optimistic outlook signals that demand remains exceptionally strong for Nvidia's artificial intelligence accelerators, the powerful and expensive chips essential for developing advanced AI models. The company had been facing increasing skepticism in recent weeks about whether the massive spending on such specialized equipment could be sustained.

Leadership Challenges Bubble Narrative

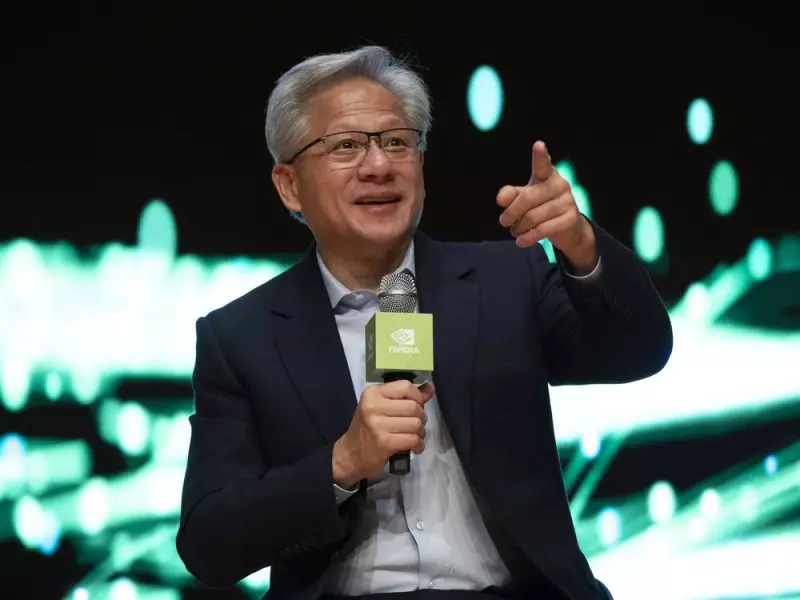

Chief executive Jensen Huang directly addressed these concerns during a conference call with analysts. "There's been a lot of talk about an AI bubble," Huang stated. "From our vantage point, we see something very different."

The company's positive commentary had an immediate market impact, sending shares up about 5.4 percent in early trading on Thursday before markets opened in New York. The stock had already gained 39 percent this year through the close, elevating the company's market value to an impressive US$4.5 trillion.

Broader Market Impact

Nvidia's results have become a crucial barometer for the overall health of the AI industry, and the positive news lifted various related stocks. CoreWeave Inc., a provider of AI computing, gained more than nine percent in extended trading, while its peer Nebius Group NV climbed more than eight percent.

International markets also responded positively, with benchmarks in South Korea, Taiwan and Japan showing gains fueled by Nvidia suppliers including Taiwan Semiconductor Manufacturing Co. and Tokyo Electron Ltd.

Brian Mulberry, senior client portfolio manager at Zacks Investment Management, noted that "markets are reacting very positively to the news that there is no slack in AI momentum. Demand for Nvidia hardware solutions remains strong." His firm owns Nvidia shares.

Nvidia's financial performance in the third quarter also exceeded expectations. Revenue rose 62 percent to US$57 billion in the period ending October 26, while profit reached US$1.30 per share. Analysts had predicted sales of US$55.2 billion and earnings of US$1.26 per share.

Looking ahead, chief financial officer Colette Kress indicated that Nvidia would likely surpass its previously announced US$500 billion revenue target. "There's definitely an opportunity for us to have more on top of the US$500 billion that we announced," she confirmed during the conference call. "The number will grow."

Huang emphasized that the expanding role of artificial intelligence across multiple sectors will continue to drive demand for Nvidia's products. The technology is not only accelerating existing computing tasks like search functions but is also poised to enter the physical world through robotics and other advanced devices.