Fraser Institute Report Ranks Canadian Premiers on Fiscal Management

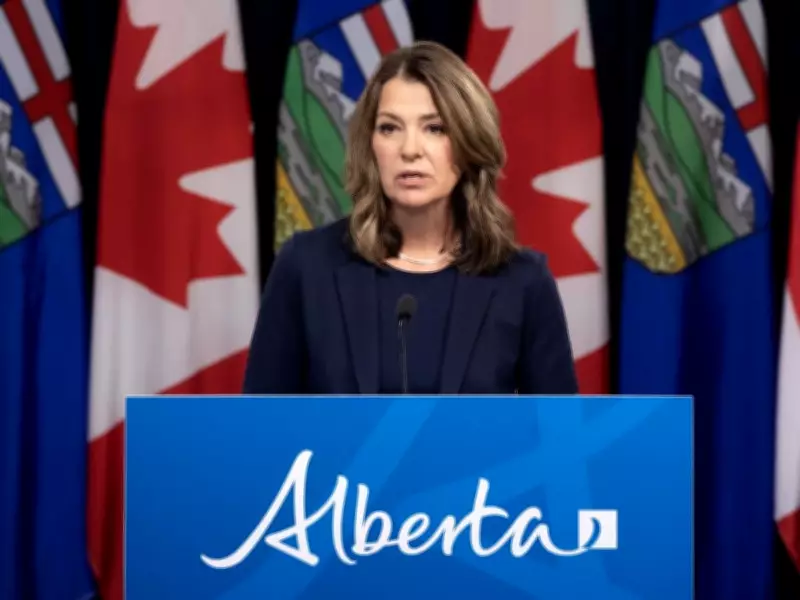

A comprehensive new analysis from the Fraser Institute has evaluated the fiscal performance of Canada's provincial premiers, with Alberta's Danielle Smith and Ontario's Doug Ford emerging as the top performers in the rankings. The study, which examines government spending, taxation policies, deficits, and debt management, provides a comparative assessment of how each premier has handled provincial finances during their time in office.

Methodology and Ranking Criteria

The principal author of the study, Jake Fuss, director of fiscal studies at the Fraser Institute, emphasizes that the scores and rankings represent relative measures of performance rather than absolute assessments. The analysis compares each premier against their counterparts, with measurements taken from the time they first assumed office until the end of the 2024/25 fiscal year.

According to Fuss, top ratings were awarded to Smith and Ford for demonstrating greater responsibility with taxpayer dollars. However, the report includes important caveats about both leaders' performances, highlighting that their rankings reflect both their own fiscal management and the comparative performance of other premiers.

Complete Premier Rankings

The full ranking of Canadian premiers in the Fraser Institute report includes:

- Danielle Smith (Alberta)

- Doug Ford (Ontario)

- Blaine Higgs (former New Brunswick premier)

- Scott Moe (Saskatchewan)

- François Legault (Quebec)

- Dennis King (former Prince Edward Island premier)

- Tim Houston (Nova Scotia)

- David Eby (British Columbia)

- Andrew Furey (former Newfoundland and Labrador premier)

- Wab Kinew (Manitoba)

It's important to note that Higgs, King, and Furey left office during the 2024/25 fiscal year, which affected their final rankings in the study.

Detailed Analysis of Top Performers

Danielle Smith's Performance: While Smith achieved the highest overall score in the rankings, the report identifies specific areas where her performance was less impressive. According to Fuss, "Premier Smith had the highest score overall but performs poorly on government spending as program spending has grown faster than Alberta's economy." The study notes that the surpluses she has overseen have been partially attributable to relatively high resource revenues. However, Smith's strong ranking stems from Alberta maintaining some of the lowest tax rates in the country, along with her success in balancing the budget and reducing debt as a percentage of GDP.

Doug Ford's Performance: Ford's second-place ranking reflects what the report describes as "relatively restrained program spending growth in comparison to other premiers." In the government spending category specifically, Ford ranked first with a score of 83.2, ahead of David Eby (80.8) and Scott Moe (69.6). He achieved the second smallest annual difference between program spending growth and provincial economic growth rates.

However, the report notes that Ford has consistently run operating deficits throughout his time in office, with only one year as an exception. Fuss explains that "Ford's second overall ranking is more a result of other premiers performing quite poorly on fiscal management than him performing particularly well."

Category-Specific Performance

The report reveals interesting contrasts when examining specific fiscal categories. In the debt and deficits category, the positions of the top two premiers reversed, with Smith ranking highest and Ford placing seventh.

Four premiers failed to achieve scores above 50 in the government spending category: Smith (47.5), Houston (46.4), Legault (41.5), and Kinew (10.9). According to the study's methodology, a premier's performance was judged as poor if program spending increased faster than economic growth or the combined rate of inflation plus population growth.

The Fraser Institute's analysis provides valuable insights into the fiscal management approaches of Canada's provincial leaders, highlighting both strengths and areas for improvement across different jurisdictions. The comparative nature of the study allows for meaningful evaluation of how premiers are managing taxpayer resources in relation to their counterparts across the country.