Regina residents delivered passionate pleas to city council this week, urging officials to protect essential services and community funding rather than implement deep cuts to offset a significant proposed tax increase for 2026.

Public Delegates Advocate for Sustained Investment

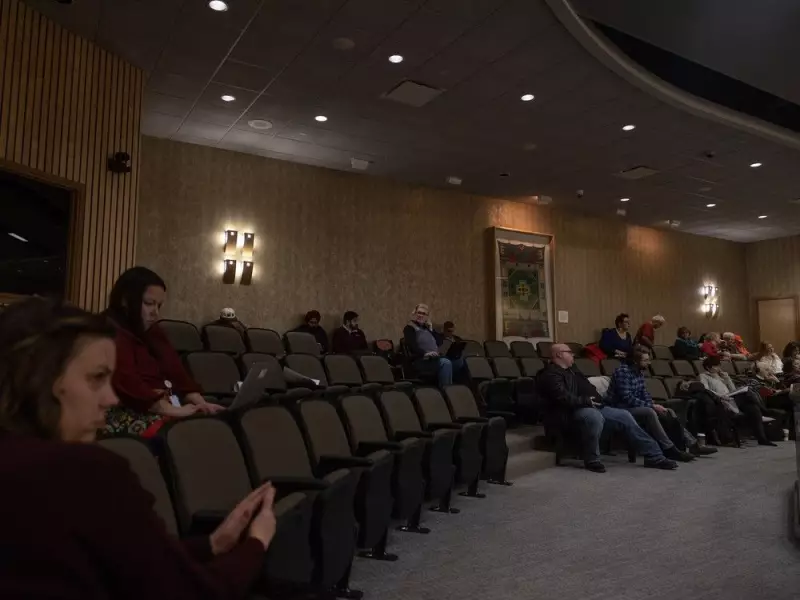

The week-long budget deliberations at Regina City Hall saw over 60 residents, community associations, and non-profit organizations participate. The central point of contention is a 15.69 per cent mill rate increase that city administration says is required to maintain current service levels next year.

Apurva Krishna Chaltany shared a personal story with councillors, recalling how a city bus rescued her and her father from a dangerous blizzard after a concert. "Isn't that the point of taxes, to support initiatives that support the community?" she asked, arguing against cuts to services like Regina Transit.

Her sentiment was echoed by many. Fifty delegates spoke in-person, and another 152 submitted written letters, largely advocating to preserve Regina's vibrancy and livability by protecting core services and the $5.7-million Community Investment Grant program, which supports local non-profits.

Business Concerns and Calls for Fiscal Restraint

Not all voices called for maintaining the spending status quo. A smaller contingent, including a handful of delegates and ten written letters, urged council to curb spending, citing the strain on household budgets.

The Regina & District Chamber of Commerce voiced strong opposition to the large tax hike. Executive Director Mike Tait highlighted the "double hit" on businesses from higher property valuations in 2025 combined with the proposed mill rate jump. "A nearly 16 per cent increase cannot be viewed as being consistent with a commitment to affordability," Tait stated.

Legacy of 'Underinvestment' Blamed for Sharp Hike

Ian Cantello, president of the Regina Civic Middle Management Association, provided context for the startling figure. He argued the proposed increase is partly due to a backlog from two decades of insufficient tax policy.

"You can go back to what I'll term as the original sin of (former mayor) Pat Fiacco starting to put in zero-per-cent mill rate years," Cantello said. "This is a big jump this year because it's dealing with years of underinvestment."

The debate sets the stage for difficult decisions as city council works to balance the financial pressures on residents and businesses with the need to fund municipal operations and community services for the coming year.