Global financial markets presented a mixed picture on Wednesday, December 24, 2025, following a historic milestone on Wall Street. The S&P 500 index surged to a record closing high, a rally primarily fueled by the release of stronger-than-anticipated economic data from the United States.

Record-Breaking Rally on Wall Street

The benchmark S&P 500 index reached an all-time high in the previous trading session. This significant achievement was largely attributed to positive U.S. economic reports that bolstered investor confidence. The data suggested underlying economic resilience, prompting a wave of buying activity in key sectors.

International Markets Show Divergent Paths

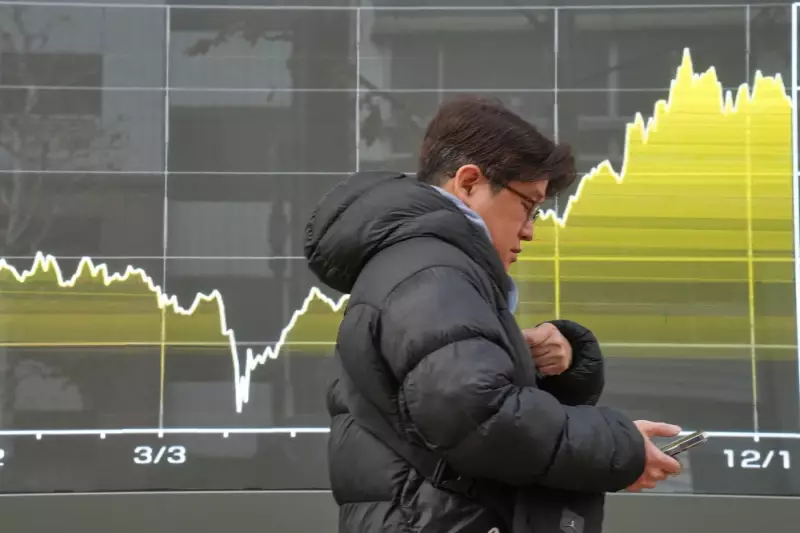

In the wake of the U.S. rally, trading floors across Asia and Europe displayed varied reactions. For instance, in Tokyo, Japan's Nikkei index experienced its own movements, as captured in a recent photograph from a securities firm. While some major indices attempted to follow Wall Street's lead, others faced headwinds from local economic concerns or profit-taking, resulting in a fragmented global landscape.

The divergence highlights how regional factors continue to influence market performance, even when a dominant trend emerges from the world's largest economy. Analysts are closely monitoring whether the momentum from the U.S. can be sustained and spread more broadly, or if markets will remain selective in their response.

Implications for Investors and the Economic Outlook

The record-setting performance of the S&P 500, supported by solid economic fundamentals, signals optimism about the near-term trajectory of the U.S. economy. However, the mixed response from global markets serves as a reminder of the complex, interconnected nature of international finance.

Key considerations for the coming weeks include:

- The sustainability of U.S. economic growth and its ability to offset softer conditions elsewhere.

- Potential shifts in monetary policy by central banks in response to new data.

- The impact of geopolitical events on commodity prices and trade flows.

For investors, this environment underscores the importance of a diversified portfolio and a focus on long-term fundamentals rather than short-term volatility. The market's reaction demonstrates that while U.S. data is a powerful driver, it is not the sole factor dictating global financial sentiment as 2025 draws to a close.