Canadian and U.S. Stock Markets Experience Significant Gains

The S&P/TSX composite index, a key benchmark for Canadian equities, demonstrated robust performance by climbing more than 100 points. This upward movement signals a positive shift in investor confidence within the domestic market. Concurrently, U.S. stock markets also recorded notable increases, contributing to a broader trend of financial optimism across North America.

Factors Influencing the Market Rally

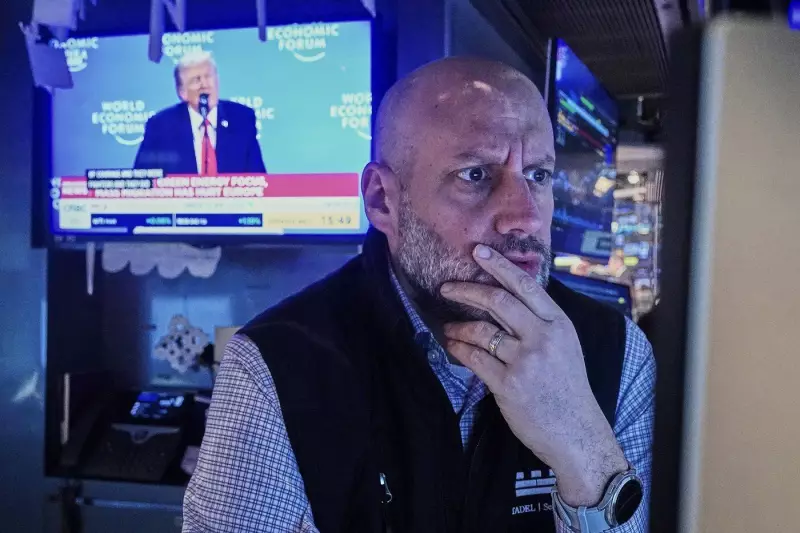

Several elements may be driving this market upswing. Global economic forums, such as the World Economic Forum in Davos, often serve as catalysts for market movements as world leaders and financial experts discuss future policies and trade relations. Additionally, corporate developments, including announcements from major companies, can impact investor behavior and stock valuations.

It is important to note that market fluctuations are influenced by a complex interplay of domestic and international factors. These can range from geopolitical events and trade agreements to corporate earnings reports and economic data releases. Investors typically monitor these indicators closely to make informed decisions.

Broader Economic Context

The rally in both Canadian and U.S. markets occurs within a larger economic landscape. Discussions around trade expansion, such as potential engagements with countries like India, and corporate relocations, like GFL Environmental moving its executive headquarters, highlight the dynamic nature of global business. Such activities can affect market sentiment and contribute to stock performance.

While short-term gains are encouraging, long-term market stability depends on sustained economic growth and prudent fiscal policies. Analysts often emphasize the importance of diversification and risk management in investment portfolios, especially during periods of market volatility.

Overall, the recent gains in the S&P/TSX composite and U.S. stock markets reflect a moment of financial optimism. However, investors are advised to stay informed about ongoing economic developments and consider consulting with financial advisors to navigate the complexities of the stock market effectively.