Global financial markets kicked off the first trading week of 2026 with a significant milestone, as Japan's premier stock index surged to an unprecedented level. The positive sentiment in Tokyo contributed to a mostly higher session for world shares, while energy markets also saw upward movement.

Tokyo's Historic Trading Day

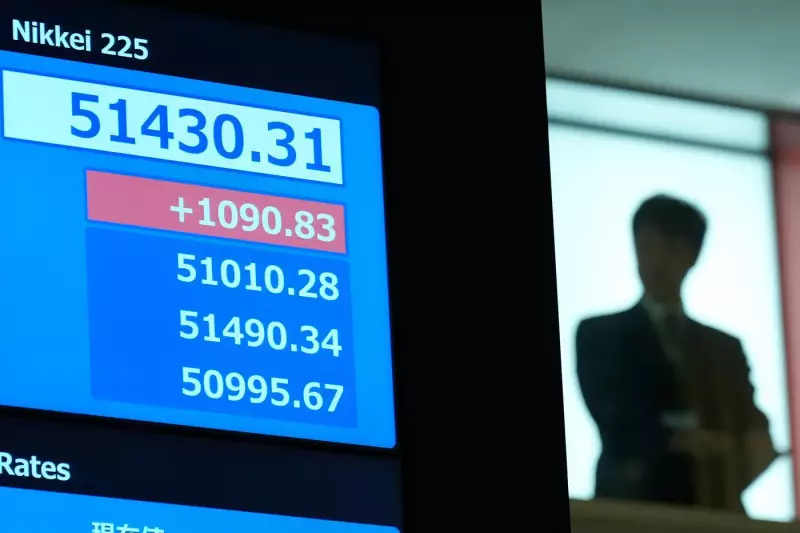

The standout performance came from Asia, where Tokyo's Nikkei 225 index closed at a record high on Monday, January 5, 2026. The surge followed a traditional ceremony marking the start of the year's trading at the Tokyo Stock Exchange. The bullish activity sets a confident tone for the region's economic outlook at the beginning of the new year.

Broad Market Gains and Commodity Movements

Influenced by the strong showing in Japan, share prices in other major markets around the world mostly registered gains. While specific percentages for other indices were not detailed in the initial report, the overall trend pointed to investor optimism. Concurrently, oil prices advanced, indicating heightened demand expectations or tightening supply conditions in the energy sector. This dual rise in equities and crude oil suggests a complex interplay of factors driving global asset values.

Context and Implications

The record-setting day for the Nikkei 225 represents a pivotal moment for Japanese equities, potentially reflecting corporate earnings strength, monetary policy expectations, or broader regional stability. The correlated climb in oil prices further underscores the interconnected nature of commodity and equity markets. Analysts will be watching closely to see if this positive momentum sustains itself throughout the coming weeks, setting a definitive trend for 2026. The performance stands in contrast to various domestic Canadian news items, from weather advisories to local policy debates, highlighting the divergent narratives between international finance and day-to-day regional affairs.