The Montreal real estate market is showing signs of a strategic shift as the final months of 2025 unfold. New data reveals a cooling in sales activity, which experts suggest is opening a window of opportunity for prospective buyers who have been waiting on the sidelines.

November Sales Show Measured Slowdown

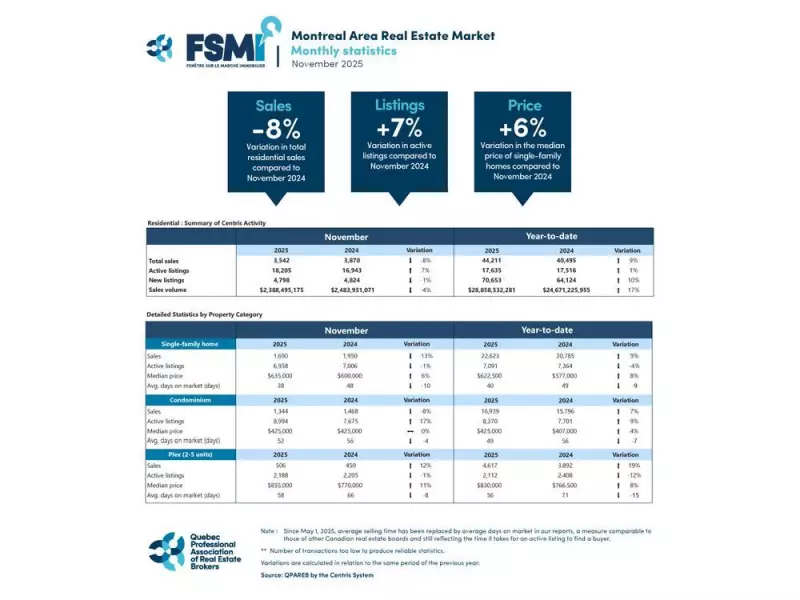

According to the latest statistics from the Quebec Professional Association of Real Estate Brokers (QPAREB), 3,542 residential sales were completed in the Montreal Census Metropolitan Area (CMA) in November 2025. This figure represents an 8 per cent decrease compared to the exceptionally active market of November 2024. However, when viewed in a broader context, this year's performance aligns closely with the 10-year average for the month.

"Despite the decline recorded in November, year-to-date sales are up 9 per cent, which will make 2025 a particularly strong year for the Montreal market," said Camille Laberge, QPAREB Assistant Director and Senior Economist. Laberge attributed the year's overall momentum to declining interest rates and the effects of rapid population growth driven by positive net migration.

Diverging Trends Across Property Types and Regions

The slowdown was not uniform across all property categories or geographic areas. Sales of single-family homes fell by 13 per cent, while condominium transactions dropped by 8 per cent. In contrast, the plex (multi-unit residential property) segment bucked the trend entirely, posting a 12 per cent increase in sales. The 506 plex transactions recorded mark the third-best November performance in two decades.

Geographically, five of the six major sectors saw sales declines, ranging from a modest 3 per cent on the Island of Montreal to a more pronounced 16 per cent on the South Shore. Vaudreuil–Soulanges was the sole region to post growth, with a 5 per cent increase in sales.

Growing Inventory Signals Market Rebalancing

A key development for buyers is the continued expansion of available properties. Active listings grew by 7 per cent year-over-year in November, reaching 18,205 properties for sale. This marks the fourth consecutive month of supply growth, a trend driven exclusively by a 17 per cent surge in condominium listings. The supply of single-family homes and plexes remained slightly tighter, declining by 1 per cent.

Charles Brant, QPAREB Market Analysis Director, explained the dynamic: "Property prices in Montreal, particularly on the island, have reached levels that far exceed the financial capacity of many buyers... This lack of affordability is contributing to the market’s slowdown. On the other hand, it is also allowing the inventory of properties for sale to gradually rebuild."

The inventory build-up is most significant on the Island of Montreal, Laval, and the South Shore—areas with high concentrations of condominiums. Supply in more outlying regions continues to decline.

Price Movements and Selling Times Reflect Changing Conditions

The varying supply dynamics are directly influencing price trends. The median price of plexes rose sharply by 11 per cent to $855,000. Single-family homes saw a 6 per cent price increase, reaching a median of $635,000. For condominiums, however, the increase in supply and easing market conditions halted more than two years of consecutive price gains, with the median price remaining stable compared to November 2024.

Despite the growing inventory, the market overall remains in seller's territory, especially for plexes. The time needed to sell a property decreased across the board: single-family homes sold in an average of 38 days (10 days faster), plexes in 58 days (8 days faster), and condominiums in 52 days (4 days faster).

This new data paints a picture of a Montreal real estate market in transition. While still historically active, the initial slowdown and rebuilding inventory are creating a more balanced environment, offering cautious optimism for buyers seeking opportunities in the coming months.