The Greater Toronto Area housing market closed 2025 with a notable shift towards greater affordability, as a combination of higher inventory and economic uncertainty led to a significant drop in sales and a moderation in prices, according to year-end data from the Toronto Regional Real Estate Board.

Annual Sales Decline Amid Economic Headwinds

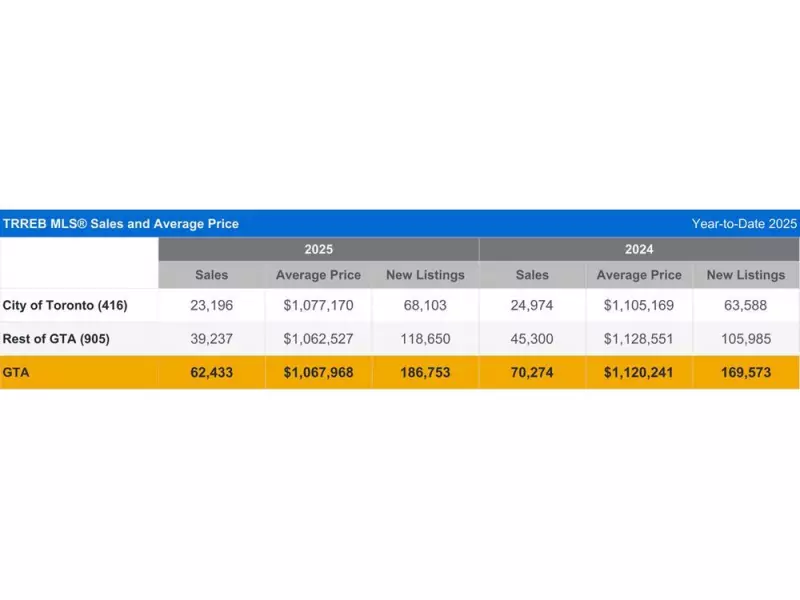

GTA REALTORS® reported 62,433 home sales for the 2025 calendar year, a decrease of 11.2 per cent compared to the previous year. This decline occurred alongside a substantial 10.1 per cent year-over-year increase in new listings, which reached 186,753. The elevated supply of homes for sale provided buyers with more negotiating power, contributing to a downward trend in selling prices.

The annual average selling price for 2025 was $1,067,968, marking a 4.7 per cent decline from the 2024 average of $1,120,241. TRREB President Daniel Steinfeld linked the market's performance to broader economic conditions. "The GTA housing market became more affordable in 2025 as selling prices and mortgage rates trended lower," Steinfeld stated. "Improved affordability has set the market up for recovery."

December Data Reflects Year-End Trend

The year-end pattern continued into December. Home sales for the month totaled 3,697, an 8.9 per cent drop from December 2024. New listings saw a modest increase of 1.8 per cent, reaching 5,299. The MLS® Home Price Index (HPI) Composite benchmark was down 6.3 per cent year-over-year, while the average selling price for December 2025 was $1,006,735, a 5.1 per cent decrease from the same month in 2024.

On a seasonally adjusted monthly basis, sales in December were slightly lower than in November 2025, while new listings increased. The MLS® HPI composite trended slightly lower month-over-month, though the average selling price edged higher.

Path to Recovery Hinges on Consumer Confidence

Board officials emphasized that the foundation for a market rebound is now in place, but its timing depends on restoring household confidence. "Once households are convinced that the economy and labour market are on a solid footing, sales will increase as pent-up demand is satisfied," explained President Steinfeld.

TRREB Chief Information Officer Jason Mercer pointed to broader economic factors as key drivers for future improvement. "Reaffirmed trade relationships and large-scale domestic economic development projects will be key for improved home sales moving forward," Mercer said. "GTA households must be confident in their employment situation before committing to long-term monthly mortgage payments, even in this more affordable market."

The board also called for government action to support potential buyers. TRREB CEO John DiMichele urged all levels of government to implement tax relief to ease the cost of living. "Families and individuals need financial breathing room so they can afford a home or apartment and meet their basic needs," DiMichele said. He argued that such policies could restore consumer confidence and help rebuild trust in the economy.