An Ontario man says he is deeply alarmed by the relentless climb in his home and auto insurance premiums, a sentiment echoing across the province as financial pressures mount. The steep increases are being driven by a confluence of factors, including a surge in extreme weather events, persistent inflation, and skyrocketing costs for home repairs and construction materials.

The Perfect Storm Driving Premiums Higher

Home insurance rates have been rising steadily, creating a significant burden for homeowners. Industry analysts point to a clear chain of causation. The increasing frequency and severity of storms, floods, and wildfires have led to a higher volume of costly insurance claims. Simultaneously, the economic landscape marked by inflation has made everything from lumber to labor more expensive, driving up the cost to repair or rebuild a home after damage occurs. Insurers, facing greater payouts and higher operational costs, are passing these expenses on to policyholders.

A Personal Financial Shock

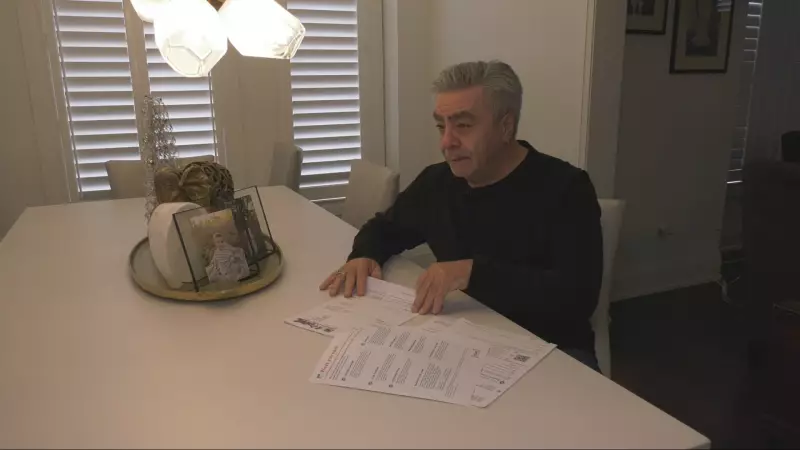

The abstract economic trends translate into real financial stress for individuals and families. For the Ontario man featured, reviewing his renewal statements was a jarring experience. The compounded increase for both his vehicle and his property coverage has forced a reevaluation of his household budget. His story is not isolated; consumer advocates report a growing number of calls from Canadians struggling to absorb these added costs while dealing with other inflationary pressures like groceries and fuel.

What Can Consumers Do?

Financial experts recommend that policyholders not simply accept renewal notices at face value. Shopping around for quotes from different providers remains one of the most effective ways to potentially find better rates. Consumers are also advised to review their policies carefully to ensure they are not over-insured and to inquire about all available discounts, such as those for bundling home and auto policies, installing security systems, or having a claims-free history. Increasing deductibles can lower premiums, though this means paying more out-of-pocket if a claim is made.

The situation underscores a broader economic challenge facing Canadians. As climate-related risks intensify and the cost of living remains high, essential services like insurance are becoming a more substantial slice of the monthly expense pie, prompting calls for greater transparency and consumer protection in the industry.