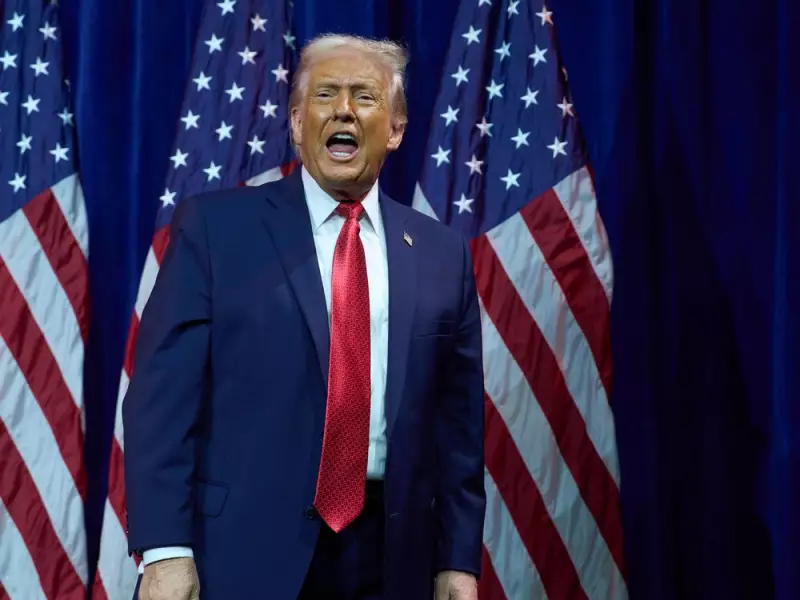

In a significant geopolitical and economic development, U.S. President Donald Trump announced late Tuesday that Venezuela's interim authorities will transfer a massive volume of oil to the United States. The move, valued at approximately US$2.8 billion at current prices, marks a dramatic shift in the Western Hemisphere's energy landscape following the capture of Venezuelan leader Nicolas Maduro.

A Strategic Energy Pivot

President Trump detailed the arrangement in a social media post on January 6, 2026. "I am pleased to announce that the Interim Authorities in Venezuela will be turning over between 30 and 50 MILLION Barrels of High Quality, Sanctioned Oil, to the United States of America," he wrote. Trump further stated that the oil would be sold at market price, with the proceeds controlled by his administration to "benefit the people of Venezuela and the United States."

The announced volumes are substantial, representing an estimated 30 to 50 days of Venezuela's current oil production levels, which have been severely reduced from historic highs due to years of underinvestment and a partial U.S. blockade. The news immediately impacted markets, with the U.S. benchmark West Texas Intermediate crude falling as much as 2.4% following the announcement, trading near US$56 a barrel.

Geopolitical Repercussions and Market Impact

This deal represents a major strategic victory for the U.S. as it seeks to extend its economic influence in Venezuela. It also deals a direct blow to China, which had been the top buyer of Venezuelan crude and a close political and economic partner of the Maduro regime. Analysts see this as a forceful application of U.S. foreign policy in the region.

"The Trump administration’s aggressive reassertion of the Monroe Doctrine will have far-reaching implications for China," said Christopher Beddor, deputy China research director at Gavekal Dragonomics. "It’s probably going to force a rethink of China’s import reliance on natural resources from many other Latin American countries." He added that Beijing is likely preparing for a scenario where all its Venezuelan oil shipments cease.

Logistical Realities and Future Challenges

The announcement came with few operational details. Representatives from the U.S. Energy Department, the White House, and Venezuela's information and oil ministries did not respond to requests for comment. A key question is the oil's origin. Venezuela has a significant backlog of unshipped crude stored on land and aboard idle tankers since the U.S. blockade began last month, with state-owned Petroleos de Venezuela SA (PDVSA) reportedly running out of storage space.

Despite possessing the world's largest proven crude reserves, Venezuela now accounts for less than one percent of global supply. Experts agree it will take years and billions in investment to revive its crippled oil industry meaningfully. The last American company operating there, Chevron Corp., continues production under a U.S. sanctions exemption and has booked a fleet of ships to transport oil from Venezuelan ports.

This unprecedented transfer of resources underscores a rapidly changing political situation in Caracas and signals a potential realignment of global energy trade routes, with the United States poised to gain both economic and strategic leverage.