Venezuela Oil Shock Intensifies Alberta's Budget Crisis

Alberta is confronting its most severe fiscal predicament since the COVID-19 pandemic, as a potential surge of Venezuelan oil threatens to further depress the price of heavy crude. This development poses a significant risk to one of the Canadian province's primary revenue streams, exacerbating existing budget pressures.

Geopolitical Events Trigger Market Volatility

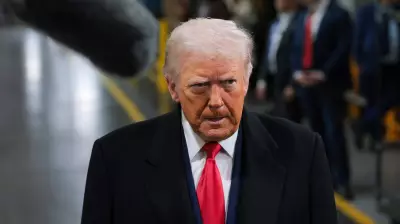

United States President Donald Trump announced on January 6 that Venezuela would release up to 50 million barrels of oil following the capture of President Nicolas Maduro by U.S. forces. Venezuelan crude shares similar characteristics with the dense, high-sulphur product extracted from Alberta's oil sands. The anticipated influx of millions of barrels to Gulf Coast refineries has already widened the discount for Canadian crude, creating immediate financial headwinds for Alberta.

As a direct consequence, the provincial budget deficit for the fiscal year commencing April 1 could escalate to as much as $11.6 billion (US$8.4 billion) under a worst-case scenario, according to an analysis by Randall Bartlett, deputy chief economist at Desjardins. This would represent the largest deficit since 1990, excluding the two peak pandemic years.

Economic Experts Sound Alarm on Fiscal Stability

Trevor Tombe, an economics professor at the University of Calgary, emphasized the gravity of the situation, stating, "It's hard to understate how challenging the current moment is financially for the government." Tombe projects the deficit may reach $10 billion, highlighting the volatility of natural resource revenues, which constitute Alberta's second-largest income source.

The financial strain was evident even before recent events in Venezuela. In November, the provincial government revised its current-year deficit estimate to $6.4 billion, marking a 24 per cent increase from projections in the previous February's budget.

Broader Market Pressures Compound the Crisis

Alberta's fiscal challenges are compounded by a sustained decline in global oil prices, driven by increased crude supplies from OPEC+ nations and economic uncertainty stemming from U.S. tariffs. Western Canadian Select, Canada's benchmark for heavy crude, consistently trades at a discount to the monthly average of West Texas Intermediate.

Following the military operation in Venezuela, this discount expanded to nearly US$15 per barrel, the widest gap since January of last year when the Trump administration threatened tariffs on Canadian crude. Prior to the intervention, the discount stood at just over US$13 per barrel.

West Texas Intermediate experienced a 20 per cent decline last year and has predominantly traded around US$60 per barrel or lower since mid-November. Notably, Alberta's government had based its current year's budget on an oil price projection of $68 per barrel, creating a substantial revenue shortfall.

Persistent Dependence on Resource Revenues

Natural resources, including oil and gas royalties, accounted for approximately 27 per cent of Alberta's revenue in the last fiscal year, down from 33 per cent two years earlier. Despite ongoing efforts to diversify the economy and reduce reliance on oil—such as establishing a provincial fund to invest oil and gas royalties—Alberta's economic fortunes remain inextricably linked to crude price fluctuations.

The anticipated deficit for the current year will be the first since 2020-21, when the pandemic caused employment and energy demand to collapse, briefly pushing oil prices into negative territory. Subsequently, oil prices soared to their highest levels in over a decade following Russia's invasion of Ukraine in 2022.

Comparative Economic Resilience Amidst Challenges

Despite these fiscal pressures, Alberta maintains a stronger economic position relative to other Canadian provinces. Unlike the car parts, aluminum, and steel produced in Ontario and Quebec, Alberta's hydrocarbons can enter the U.S. market duty-free. According to the Bank of Montreal's economics department, Alberta is projected to lead Canada in gross domestic product growth this year, underscoring its underlying economic vitality even amidst budgetary constraints.