The removal of Venezuelan leader Nicolas Maduro by American forces has sent immediate shockwaves through financial markets, with Canadian energy stocks taking a significant hit at the start of the week. Major players like Cenovus, Suncor, and Canadian Natural Resources saw their stock values decline, while American giants such as Chevron, ConocoPhillips, and Exxon experienced a rise.

The New Competitive Landscape for Heavy Crude

This market reaction stems from the early analysis of what a stabilized Venezuela could mean for global oil supply. Venezuela possesses the world's largest proven oil reserves, and its crude is a heavy, sour grade—directly comparable to the oil produced in Alberta's oil sands. Essentially, Canadian oil has just gained a formidable competitor on the international stage.

The situation is exacerbated by what analysts describe as a decade of stifling policies under the previous Trudeau government. During that period, critical pipeline projects—including the expansion to British Columbia's coast, the Energy East project to New Brunswick, and the Keystone XL pipeline to the United States—were cancelled or obstructed. This has left Canada overly reliant on the U.S. market and without diversified export routes.

The Immediate Risk: Capital Flight, Not Barrel Replacement

While the long-term concern is Venezuelan oil replacing Canadian barrels in U.S. refineries, the more pressing danger is investment capital heading south. Former U.S. President Donald Trump has explicitly stated his intention to have major American oil companies invest billions to repair Venezuela's crumbling oil infrastructure.

An optimistic note from JP Morgan analysts suggested Venezuela could ramp up production from roughly 800,000 barrels per day to between 1.3 and 1.4 million barrels if conditions improve. This potential, however distant, is drawing investor attention away from Canada.

The contrast is stark. In the 1990s, the U.S. imported more oil from Venezuela than from Canada. Refineries on the Gulf Coast were built for Venezuelan heavy crude. Canada's share grew due to instability under Hugo Chavez and Nicolas Maduro, reaching 52% of all U.S. oil imports by 2023. That dominant position is now perceived to be at risk.

A Call for Urgent Action and Policy Clarity

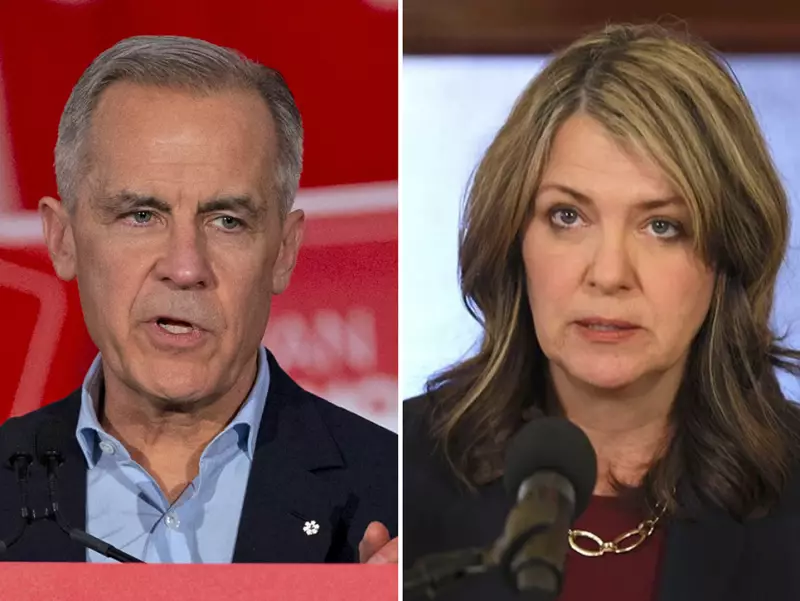

Observers argue this is not a time for complacency from Canada's political leadership or energy sector. The recent agreement between Prime Minister Mark Carney and Alberta Premier Danielle Smith, which was seen as a positive step after years of federal-provincial tension, now appears insufficient given the accelerated competitive timeline.

The core challenge is that Venezuela, despite its political risks, may now be viewed as a more attractive investment destination than Canada. Industry voices point to Canada's own set of risks: a complex and shifting regulatory environment, unpredictable Indigenous consultation processes for projects like pipelines in B.C., and a court system seen as adding uncertainty.

The path forward, according to sector analysts, requires a decisive and sustained shift in policy to make Canada a safe, reliable, and competitive destination for energy investment. The question remains whether the current federal government under Mark Carney can deliver the bold action needed to prevent capital and market share from flowing to a resurgent Venezuela.