Vancouver-based clean technology firm SHARC International Systems Inc. has released its financial performance for the third quarter and first nine months of 2025, showcasing significant revenue growth and a robust sales pipeline that points to a transformative year ahead.

Financial Performance Highlights Growth Trajectory

The company, trading as SHARC Energy, reported revenue of $2.69 million for the nine months ended September 30, 2025. This figure represents a substantial 15% increase over the $2.34 million reported in the same period in 2024. Notably, the year-to-date revenue has already surpassed the company's total revenue for the entire 2024 fiscal year, which was $2.17 million.

For the third quarter specifically, SHARC Energy posted revenue of $0.83 million, marking a 6% improvement from the $0.79 million recorded in Q3 2024. The company's leadership is confident that this momentum will push full-year 2025 revenue beyond the $3 million mark, which would be a historic milestone.

Sales Pipeline and Backlog Provide Future Visibility

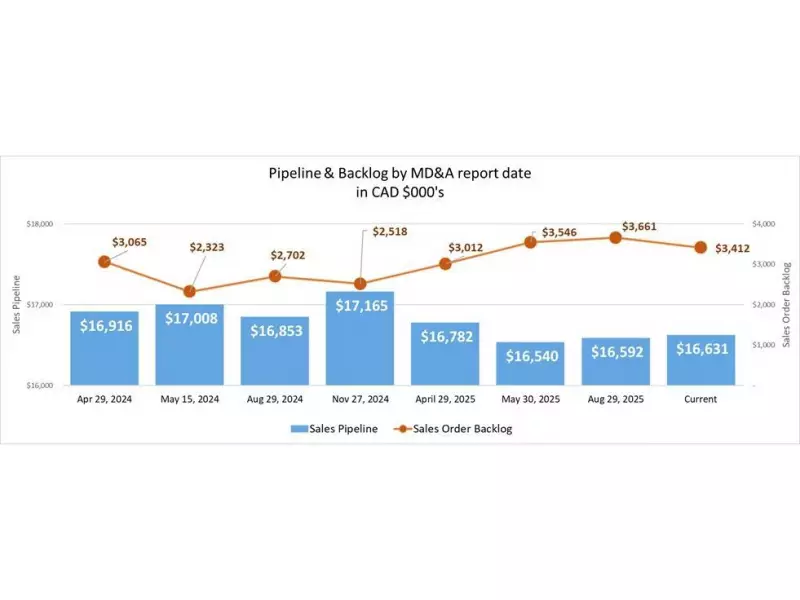

As of December 1, 2025, SHARC Energy's financial future appears bolstered by a strong sales pipeline valued at $16.6 million and a sales order backlog of $3.4 million. Management notes that this backlog is expected to convert to revenue within an average of 12 months, providing a clearer line of sight into future performance.

The current $3.4 million backlog alone represents a 58% improvement compared to the company's total 2024 revenue. CEO Michael Albertson emphasized that the backlog is evolving in both volume and project diversity, with large-scale district energy projects in final negotiations that could individually rival the value of the existing backlog.

Improved Margins and Path to Profitability

SHARC Energy also demonstrated progress in its operational efficiency. Gross margins for the third quarter of 2025 reached 39%, up from 32% in Q3 2024. For the nine-month period, gross margins were 38%, compared to 37% the previous year.

While the company reported a net loss of $0.74 million for Q3 2025, this represents a 12% reduction from the $0.83 million loss in the comparative quarter. More significantly, the Adjusted EBITDA loss showed a 22% improvement, narrowing to $0.5 million from $0.64 million. For the year-to-date period, the Adjusted EBITDA loss improved by 7% to $1.53 million.

In a statement, CEO Michael Albertson framed 2025 as a turning point, stating the accelerating adoption of SHARC's wastewater energy recovery technology is setting the stage for a transformational 2026. The company's focus on converting its mature sales pipeline into a consistent revenue stream aims to reduce volatility and create a strong platform for scaling its sustainable energy solutions.