The streaming landscape could be poised for a seismic shift as Netflix moves to acquire Warner Bros. Discovery in a deal valued at a staggering US$72 billion. The proposed merger, announced this week, is already drawing significant attention from regulators and industry analysts who are questioning its potential impact on market competition.

Antitrust Concerns Emerge Immediately

Despite the companies touting the benefits of the combination, the deal is facing early and notable antitrust pushback. Legal experts and consumer advocacy groups are raising flags about the concentration of media power. The acquisition would bring a vast library of iconic franchises, including HBO's prestige content, DC superhero films, and major reality TV brands, under the Netflix umbrella, potentially reducing consumer choice and increasing market dominance.

The reaction from regulatory bodies is expected to be intense. Analysts predict a lengthy review process by competition bureaus in both the United States and other key markets, including Canada, where the combined entity would hold a substantial share of the digital streaming subscription market.

What Changes Could Canadian Streamers See?

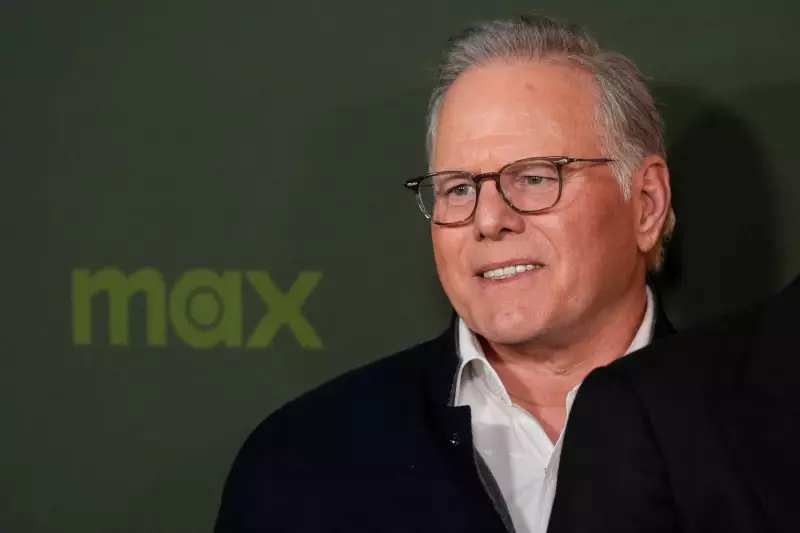

For Canadian subscribers, the deal raises immediate questions about content availability, pricing, and the future of distinct streaming platforms. A primary concern is the fate of the existing Warner Bros. Discovery streaming service, Max. Would it be folded entirely into Netflix, or would key content be licensed elsewhere?

The potential integration of Warner Bros.'s massive film and television catalog could make Netflix's library even more formidable, potentially justifying future price increases. Conversely, it could lead to a more consolidated and simplified streaming environment for users tired of managing multiple subscriptions. The deal also highlights the ongoing trend of consolidation in the media industry, as companies seek scale to compete in the costly content arms race.

The Road Ahead for the Mega-Deal

While the financial and strategic rationale for the merger is clear, the path to completion is fraught with regulatory hurdles. The companies will need to convincingly argue that the combination will not stifle competition or harm consumers through reduced innovation and higher prices. This will involve presenting detailed plans to regulators about how they will operate post-merger.

The outcome of this proposed acquisition will be closely watched as a bellwether for the future of the global media and streaming industry. If successful, it could trigger a new wave of mergers and acquisitions as other players seek similar scale. For now, subscribers, investors, and competitors are left to ponder what a Netflix-owned Warner Bros. Discovery would truly mean for the future of entertainment.