Canadian consumers are grappling with a dual financial pressure: persistently rising prices and increasingly aggressive tip prompts, a phenomenon experts warn shows no signs of abating. This combination is squeezing household budgets and altering social norms around spending and gratuities.

The Psychology of Modern Tipping

Experts point out that the act of tipping has become significantly more psychologically charged. Wayne Smith, a professor of hospitality and tourism management at Toronto Metropolitan University (TMU), identifies the steady increase in suggested tip percentages as part of a broader pattern often labeled 'tip creep.' This trend sees default options on payment machines climbing from traditional levels, creating social anxiety for customers at checkouts.

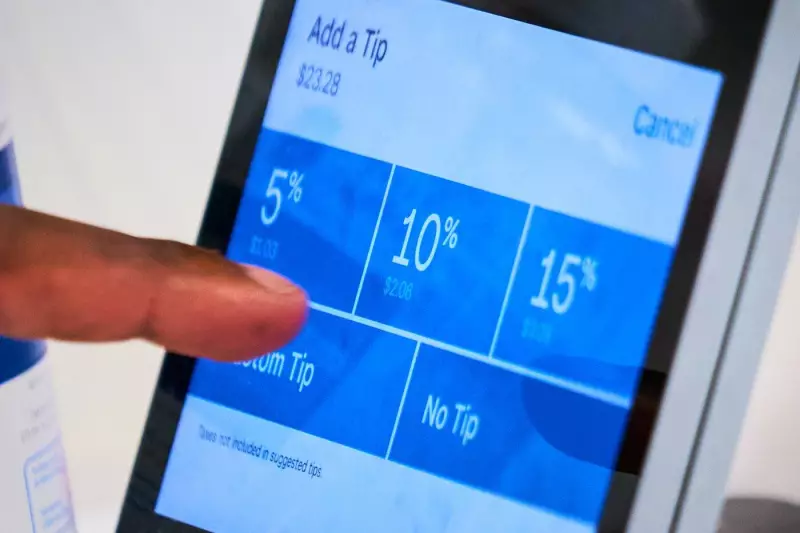

The digital payment revolution has amplified this effect. Where customers once calculated a tip based on service, they now face a screen demanding an immediate, public decision with pre-set options that often start at 18%, 20%, or even 25%. This shift places the onus on the consumer to actively opt for a lower amount, often under the perceived judgment of the cashier or server.

A Broader Landscape of Economic Strain

The issue of tip creep is not occurring in a vacuum. It unfolds against a backdrop of sustained inflation and rising costs for goods and services across the board. Consumers are feeling the pinch from grocery bills to housing, making the additional pressure from escalating tip expectations particularly burdensome.

This financial strain is having tangible effects on businesses as well. Separate forecasts suggest that the challenging economic climate could lead to the closure of approximately 4,000 restaurants across Canada in 2026. While not solely caused by tipping dynamics, this projection highlights the fragile state of the consumer-facing economy where both businesses and their customers are under significant pressure.

Navigating the New Normal

With no immediate economic relief on the horizon, experts suggest Canadians are being forced to adapt their spending habits and their approach to tipping. The conversation is shifting from a simple reward for service to a complex calculation involving personal budget constraints, perceived social obligation, and the understanding of how tips supplement wages in various industries.

As Professor Wayne Smith and other analysts observe, the endpoint of 'tip creep' remains unclear. Without a significant change in economic conditions or a broad societal pushback on payment terminal defaults, Canadians may continue to face these heightened financial prompts indefinitely. The result is a daily recalibration of what constitutes a fair tip in an era where fairness is increasingly weighed against affordability.