A significant generational shift is unfolding within Canada's banking and political landscape, underscored by the contrasting leadership styles of Prime Minister Mark Carney and his predecessor. This evolution comes as the federal government moves to streamline major resource projects.

A New Fiscal Era Under Carney

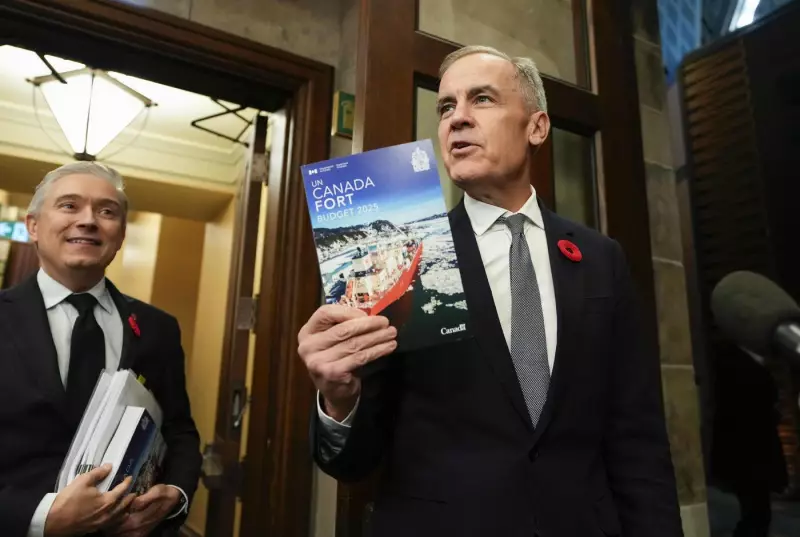

The visual of Prime Minister Mark Carney holding up the federal budget on November 4, 2025, alongside Finance Minister Francois-Philippe Champagne, has become a symbol of a changing of the guard in Ottawa. Carney's first year in office has been defined by a distinct approach, drawing clear lines between his administration and that of former Prime Minister Justin Trudeau. This generational clash extends beyond politics into the core of Canadian financial institutions, where established practices are meeting new economic visions and digital-first expectations.

Red Tape Reduction for Major Projects

In a concrete move to stimulate economic development, the federal government and Ontario are set to sign a pivotal agreement aimed at slashing regulatory hurdles. The deal specifically targets facilitating development in the Ring of Fire mineral region and other critical infrastructure projects. This initiative is designed to accelerate approvals and reduce the bureaucratic burden that has often delayed large-scale investments, signaling a more collaborative and efficiency-driven federal-provincial relationship on economic files.

Broader Economic and Business Landscape

This banking and regulatory evolution occurs within a complex national context. The business sector is digesting the implications of a massive $50-billion merger between Anglo and Teck, which British Columbia's premier has hailed as "great news" for the province. Meanwhile, other headlines capture a nation in flux: from a former grocery executive considering a political run focused on affordability, to Skate Canada's decision to stop hosting events in Alberta due to a controversial sports gender law. These disparate stories collectively paint a picture of a country navigating significant transitions in policy, commerce, and social values.

The path forward for Canadian banking and finance will likely be shaped by this intersection of new leadership, streamlined regulations for key industries like mining, and the ongoing pressures of a changing economic environment. The deal on the Ring of Fire stands as a early test case for Carney's promise of a more pragmatic and growth-oriented approach to governing Canada's economy.