Canadian authorities are sounding the alarm after two citizens were defrauded of a staggering $2.3 million in highly sophisticated cryptocurrency scams that utilized artificial intelligence. The incidents, reported in late 2025, highlight a dangerous new frontier in financial crime where fraudsters use AI to create convincing deepfake videos and personas.

The Mechanics of an AI-Powered Swindle

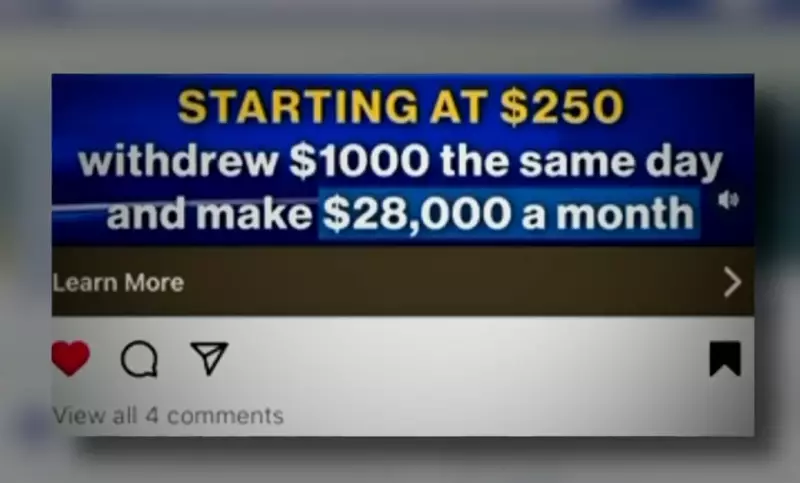

According to reports, the scams involved the use of AI-generated video and audio to impersonate trusted individuals or create fake financial experts. In one common scheme, scammers use this technology to fabricate endorsements from well-known figures or to simulate real-time video calls with a fabricated "investment manager." The victims, believing they were interacting with a legitimate opportunity, were persuaded to transfer large sums of money into fraudulent crypto wallets, which were then immediately drained.

The aggressive targeting of Canadians by these international crime rings is a major concern for the Royal Canadian Mounted Police (RCMP) and the Canadian Anti-Fraud Centre. The use of AI makes these scams exceptionally difficult to detect, as the lines between reality and fabrication are convincingly blurred.

A Growing National Threat

These multi-million dollar losses are not isolated events. They represent the sharp end of a growing wave of AI-enhanced financial fraud sweeping the country. Law enforcement agencies warn that the accessibility of AI video and voice-cloning tools has lowered the barrier for criminals, enabling them to launch personalized, large-scale attacks.

Experts advise the public to exercise extreme caution with any unsolicited investment opportunity, especially those promoted through social media or messaging apps. They stress that no legitimate financial advisor or institution will pressure you to invest immediately using cryptocurrency or wire transfers.

How to Protect Yourself

To guard against these evolving threats, cybersecurity and fraud prevention specialists recommend several key steps:

- Verify Independently: If contacted by someone claiming to be a representative of a company, end the call and contact the firm directly using official contact information from their website.

- Be Skeptical of "Guaranteed" Returns: Promises of high returns with little or no risk are classic hallmarks of fraud.

- Guard Personal Information: Never share personal details, financial data, or security codes with an unverified source.

- Educate Vulnerable Contacts: Discuss these scams with older family members or friends who may be targeted.

The $2.3 million loss suffered by the two Canadians serves as a stark reminder of the potent threat posed by AI in the hands of criminals. As the technology advances, public vigilance and continued law enforcement adaptation are critical defenses in protecting Canadians' financial security.