A Member of Parliament from Manitoba has publicly criticized Ontario Premier Doug Ford for what he calls a "terrible decision" to remove Crown Royal whisky from Liquor Control Board of Ontario (LCBO) shelves. The political rebuke comes as Premier Ford defends his actions, stating he will not hesitate to pull more alcohol products to "send a signal" to corporations that are shutting down manufacturing operations in Canada.

Political Backlash Over Provincial Retaliation

The controversy centers on Premier Ford's use of the provincial liquor monopoly as an economic lever. In a statement made on January 09, 2026, Ford indicated his willingness to escalate the removal of products from LCBO stores. His stated goal is to pressure companies that are moving their production out of the country, thereby impacting Canadian jobs. The decision to target Crown Royal, a well-known Canadian whisky brand owned by Diageo, has drawn immediate fire from politicians outside Ontario's jurisdiction.

The Manitoba MP, whose constituency was not named in the initial report by Alex Arsenych, framed the move as counterproductive and harmful. The criticism highlights the interprovincial tensions that can arise when a provincial leader takes unilateral economic action that affects nationally distributed products and brands.

Ford's Stance and the Broader Economic Signal

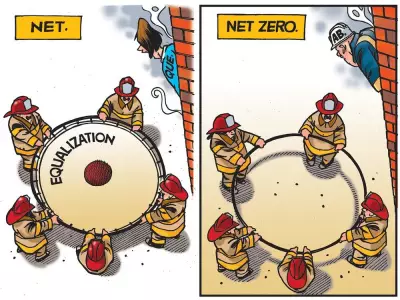

Doug Ford's position is clear: he views the LCBO's shelf space as a powerful tool for economic negotiation. By delisting products, the Ontario government can inflict significant financial pain on large corporations. "It's going to get worse in Ontario," Ford was quoted as saying, a phrase that also appeared in a separate report about the province's housing market. In this context, however, it serves as a warning to businesses that his administration is prepared to take a hard line in defense of domestic manufacturing.

This tactic is not without precedent, but its application to a major brand like Crown Royal marks a significant escalation. The LCBO is one of the world's largest single buyers of beverage alcohol, making access to its shelves crucial for sales volume in Canada's most populous province.

Implications for Business and Interprovincial Relations

The fallout from this decision extends beyond a single brand. It raises questions about the politicization of provincial retail monopolies and the potential for retaliatory measures from other provinces. Businesses with operations across Canada may now have to factor in the risk of being delisted in key markets as a consequence of corporate restructuring decisions.

Furthermore, the Manitoba MP's vocal disapproval underscores a rift in how different levels of government perceive the best way to support Canadian industry. While Ford advocates for aggressive, tangible consequences for companies leaving, others may view the approach as creating uncertainty and instability for businesses operating nationally.

The situation remains fluid, with industry watchers keen to see if other provinces will comment or if the targeted companies will alter their plans in response to Ontario's pressure campaign.