Alberta's provincial government is staring down a stark financial reality as the new year unfolds, with a bleak fiscal picture shaped by falling oil prices and waning demand. The situation raises urgent questions about the province's budgetary path and its heavy reliance on energy revenues.

A Looming Budget and Political Uncertainty

It remains uncertain whether Albertans will receive a third-quarter fiscal update before the government tables what is anticipated to be a difficult budget. Compounding this uncertainty is the possibility of an early election call, which could postpone both the budget and any fiscal update. Regardless of the political timeline, Premier Danielle Smith's government faces a series of complex decisions in the coming months.

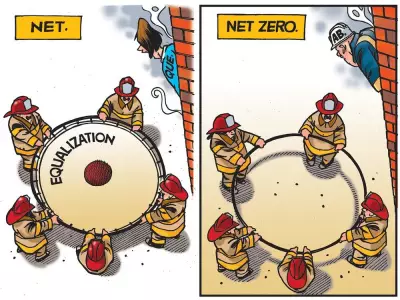

So far in 2026, the provincial focus appears directed outward, with plans for various referendums concerning grievances with the federal government, rather than inward fiscal introspection. When pressed on budgetary pressures, the government's responses have often centered on issues like immigration, equalization payments, and the lack of new pipeline infrastructure.

The Double-Edged Sword of Global Oil Markets

The global oil market is presenting significant challenges for Alberta's treasury. Recent geopolitical shifts, including developments in Venezuela, have prompted the Premier to reiterate calls for pipeline diversification. However, this comes as the United States seeks to revive Venezuelan oil production, which would add more supply to an already soft market.

This scenario poses a specific threat to the price of Western Canada Select (WCS), the benchmark for Alberta's heavy crude. Analysts warn that relaxed sanctions on Venezuela could decrease demand for Canadian oil, putting further downward pressure on prices. TD Economics forecasts West Texas Intermediate (WTI) to average $58 per barrel in the first quarter of 2026, well below the $68 per barrel forecast in Alberta's current budget.

The Staggering Cost of Price Volatility

The province's financial health is acutely sensitive to these price swings. Every one-dollar change in the price of oil translates to a gain or loss of hundreds of millions of dollars in provincial revenue. With WTI already trading below $60 per barrel, the fiscal gap is widening rapidly.

Alberta is now projecting a deficit of more than $6 billion for the current fiscal year. The most recent provincial fiscal update had still assumed per-barrel prices would remain above $60. The rapid deterioration highlights a core vulnerability: the government's increasing dependence on energy royalties to fund its operations.

The concern extends beyond the sheer size of the growing deficit. The fundamental worry for economists and policymakers is the structural reliance on a highly volatile revenue source to pay for ongoing government services and programs. As prices fall and demand forecasts weaken, Alberta's fiscal framework faces a severe stress test, forcing a reevaluation of spending and revenue plans in the near future.