In a significant announcement concerning municipal finances, the Mayor of Windsor has laid out a plan to present a budget for 2026 with a 0% increase in property taxes. The strategy, aiming to provide relief to residents amid broader economic pressures, was detailed as the city prepares its annual financial plan.

The Zero-Increase Budget Strategy

The core of the plan involves a meticulous review of city expenditures and a focus on operational efficiencies. The Mayor's office indicates that achieving a flat tax rate will require careful prioritization of services and potentially finding new revenue streams or cost savings within existing departments. The goal is to balance the budget without reducing essential services that Windsor residents rely on daily.

This initiative comes at a time when many municipalities across Canada are grappling with rising costs for infrastructure, public safety, and community services, which often translate into annual tax hikes. Windsor's push for a zero percent increase is therefore a notable departure from the norm and is likely to be scrutinized closely by both council members and the public.

Local Reaction and Broader Context

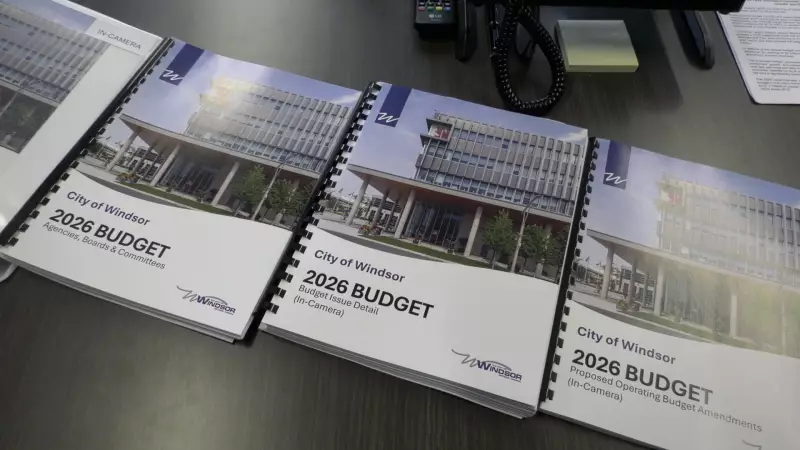

CTV Windsor's Robert Lothian gathered initial local reaction to the proposed 2026 budget. While some residents and business owners may welcome the prospect of no additional tax burden, others may express concern about how the city will maintain service levels and fund future projects. The budget deliberations will involve detailed presentations from city staff and debates among councilors to finalize the spending plan.

The announcement was made public on December 29, 2025. The full budget document, outlining all projected revenues and expenditures, will be presented to city council in the new year, where it will undergo a thorough review and approval process.

What This Means for Windsor Residents

If successfully passed, the 0% tax increase would mean property owners would see no change in the municipal portion of their tax bill for 2026. This could be a decisive factor for household budgets and local business planning. However, the final outcome depends on the city council's approval of the Mayor's proposed financial framework.

The coming weeks will be critical as details emerge on how exactly the city plans to offset inflationary pressures and meet its financial obligations without raising additional revenue from property taxes. Residents are encouraged to follow the budget process and participate in public consultations to have their say on the city's fiscal priorities.