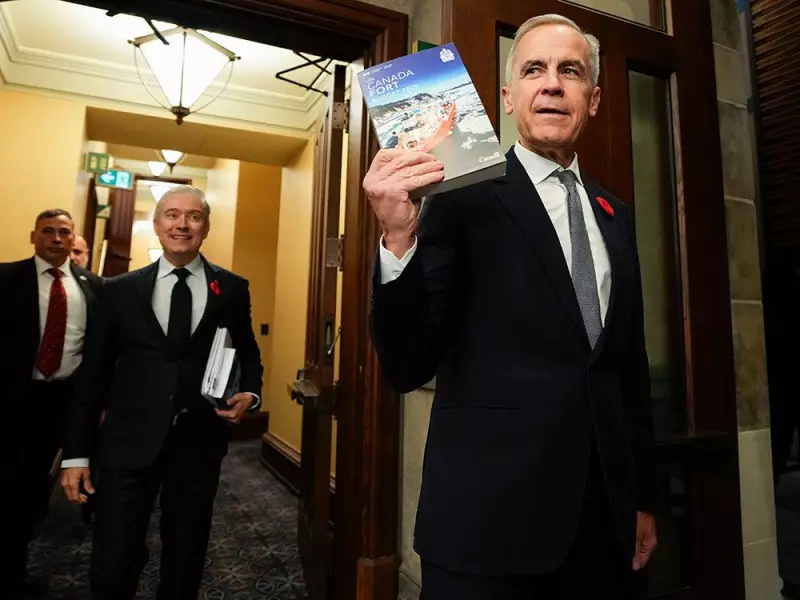

Canadian Finance Minister Chrystia Freeland has unveiled the Liberal government's highly anticipated 2025 federal budget, presenting a comprehensive economic plan that aims to balance fiscal responsibility with targeted investments in key sectors. The budget introduces significant changes to Canada's tax landscape while addressing pressing concerns around housing affordability and economic growth.

Major Tax Reforms Take Center Stage

The most headline-grabbing element of Budget 2025 involves substantial adjustments to capital gains taxation. The government is increasing the inclusion rate on capital gains for corporations and trusts from one-half to two-thirds, while individuals will see the higher rate apply to gains exceeding $250,000 annually.

This move represents the most significant shift in Canada's capital gains framework in decades and is projected to generate approximately $19.4 billion in new revenue over the next five years. The government emphasizes that only the wealthiest 0.13% of Canadians will be affected by these changes.

Housing Affordability Measures

Addressing Canada's ongoing housing crisis remains a cornerstone of the budget. The plan includes:

- Accelerated construction of affordable rental units through new funding mechanisms

- Expanded support for first-time home buyers through enhanced programs

- Increased funding for municipal infrastructure to support housing development

- Tax incentives for builders focusing on purpose-built rental properties

Economic Outlook and Fiscal Projections

The budget forecasts moderate economic growth of 1.7% for 2025, with gradual improvement in subsequent years. The government projects the deficit will reach $39.8 billion this fiscal year before beginning a slow decline.

Key economic priorities include strengthening Canada's competitive position in the global clean energy transition and supporting innovation in artificial intelligence and other emerging technologies. The budget allocates substantial funding to research and development initiatives aimed at positioning Canada as a leader in the knowledge economy.

What This Means for Canadian Households

For middle-class Canadians, the budget maintains previously announced support measures while introducing new targeted benefits. The government has emphasized its commitment to avoiding tax increases for middle-income earners while ensuring wealthier Canadians and large corporations "pay their fair share."

The budget's reception has been mixed, with business groups expressing concern about the capital gains changes potentially impacting investment, while social advocacy organizations have praised the focus on affordable housing and social programs.