A major legal battle has erupted over the future of a key U.S. consumer watchdog agency. A coalition of 21 states and the District of Columbia, all led by Democratic attorneys general, filed a federal lawsuit on Monday, December 22, aiming to stop the Trump administration from effectively defunding the Consumer Financial Protection Bureau (CFPB).

The Core of the Legal Challenge

The lawsuit, filed in a federal court in Oregon, centers on the administration's decision to stop requesting operational funding for the CFPB from the Federal Reserve. The states argue this move is unlawful and directly undermines the authority granted to Congress by the U.S. Constitution.

"The administration’s actions are a handout to those who drive up costs by cheating hardworking Americans, and I will keep fighting to ensure they follow the law and our Constitution," stated New York Attorney General Letitia James, a leading figure in the coalition.

How the CFPB is Funded and the Administration's Stance

Unlike most federal agencies that rely on annual congressional appropriations, the CFPB receives its funding directly from the Federal Reserve. This structure was established by the Dodd-Frank Act of 2010, which created the agency in the wake of the 2008 financial crisis under President Barack Obama.

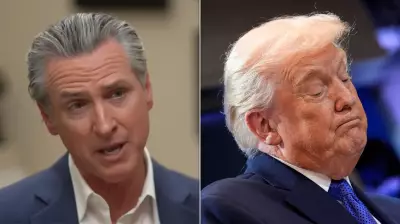

Since returning to office in January, President Donald Trump has sought to dismantle the CFPB. He installed his budget director, Russell Vought, as the agency's acting head. While litigation has stalled efforts to fire most CFPB staff, Vought has effectively halted most of its activities.

The administration's justification for withholding funding requests hinges on a technicality. The CFPB, under Vought, stated it could not ask for more money because the Dodd-Frank Act requires funding to come from the Fed's "combined earnings." As the Federal Reserve has been operating at a loss since 2022, the administration claims no earnings are available. The CFPB itself warned in a November 10 court filing that its funds are projected to run out by early 2026.

Broader Implications and Parallel Lawsuits

The coalition, spearheaded by states including California, Colorado, New Jersey, New York, and Oregon, contends that defunding the CFPB has immediate negative consequences. It would prevent the bureau from meeting its legal obligation to provide states with vital consumer complaint data, hampering enforcement efforts across the country.

Furthermore, the lawsuit asserts that the administration's actions violate the constitutional principle of separation of powers. Congress created the CFPB and its unique funding mechanism, and the executive branch cannot simply nullify that structure by refusing to act.

This state-led lawsuit is not the only legal action on this front. A federal employees' union and several non-profit organizations have filed two separate lawsuits in Washington, D.C., and California, with the same goal: to force the CFPB to resume requesting its congressionally mandated funding.

The CFPB, which its supporters say has returned more than $21 billion to consumers wronged by financial institutions, now finds its operational future entangled in a complex web of political and legal challenges.