Financial Stress Strains Canadian Relationships Ahead of Valentine's Day

As Valentine's Day approaches, many Albertans are expressing a heartfelt wish for less conflict over household finances, according to a revealing new survey from Money Mentors. The study highlights how affordability pressures and the escalating cost of living are creating significant tension in relationships across Canada, with financial disagreements becoming a common source of strain.

Survey Reveals Widespread Relationship Impact

The comprehensive survey uncovered troubling statistics about how money matters are affecting personal relationships. Nearly one in five Canadian respondents admitted they have considered ending their relationship at some point due to financial difficulties. More than half reported experiencing increased anxiety, depression, or sleep disturbances following arguments about money with their partners.

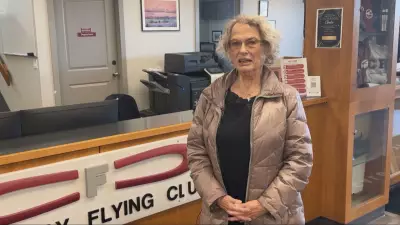

Stacy Yanchuk Oleksy, CEO of Money Mentors, emphasized that Albertans are particularly feeling the effects of rising living costs. "I think what we're seeing is the cost of living in the economic shocks that we've been having since post-COVID have really impacted Canadians," Yanchuk Oleksy explained. "We're hearing that 25 per cent are saying financial factors have negatively impacted their relationship and dating lives."

Specific Financial Pressure Points Identified

The survey pinpointed the most common sources of financial disagreement among couples:

- Day-to-day spending emerged as the primary conflict area, cited by 28 per cent of respondents

- Disagreements over lack of savings followed closely at 24 per cent

- Only 39 per cent of Canadians reported having no financial disagreements with their partner, down from 45 per cent in 2025

Yanchuk Oleksy noted that many households are experiencing significant financial stress while lacking the necessary tools to address their concerns effectively. "The data shows many households are stressed financially and lack the tools to address the concerns," she stated.

Financial Transparency and Generational Differences

Despite these pressures, financial transparency within relationships has remained relatively stable. The survey found:

- Half of respondents maintain complete financial openness with their partners, including joint bank accounts

- 40 per cent keep separate accounts but share important financial information

- Only two per cent avoid discussing finances with their partners entirely

Yanchuk Oleksy observed distinct generational approaches to financial matters. "The younger generations certainly feel less shame around their money, and we're willing to dig in and find information out, talk with other people. I think that's really positive," she said. This openness reflects broader societal shifts toward equality as more couples feature dual income earners rather than relying on a single primary breadwinner.

Addressing the Financial Education Gap

The survey revealed a persistent lack of financial education that contributes to relationship strain. Yanchuk Oleksy emphasized the importance of developing better tools for couples navigating financial matters together. "But we don't really have a lot of tools or road maps, if you will, on how to be in a relationship with someone financially," she noted.

She stressed that successful financial management within relationships requires a shared willingness to engage in difficult money conversations. This Valentine's Day, the survey suggests that what many Albertans truly desire is not just romantic gestures, but rather the foundation of financial harmony and reduced conflict over household expenses.