A New Approach to Financial Understanding for Canadians

Canadian households are navigating increasingly complex financial waters, with recent Statistics Canada data revealing a concerning trend. The household credit market debt-to-disposable income ratio climbed to 174.9 percent during the second quarter of 2025. This significant figure indicates that Canadian families now owe approximately $1.75 in credit market debt for every single dollar of after-tax income they earn.

The Changing Landscape of Personal Finance Management

This substantial debt accumulation reflects a broader economic reality where debt continues to outpace income growth for many Canadians. As financial pressures mount, traditional budgeting methods are evolving. Rather than meticulously tracking every individual transaction, Canadians are increasingly seeking comprehensive financial clarity that reveals spending patterns, identifies potential blind spots, and provides forward-looking insights into their monetary behavior.

This shift in financial management philosophy has created opportunities for innovative tools like Spendify to enter the market. The platform represents a departure from conventional budgeting applications by focusing on analytical depth rather than simple transaction monitoring.

Understanding Spendify's Unique Approach

Spendify functions as an AI-powered personal finance assistant with a distinctive operational model. Unlike many financial applications that require direct, ongoing access to live bank accounts, Spendify analyzes uploaded financial statements in formats including PDF, CSV, and image files. This security-first methodology appeals particularly to users who value privacy and prefer not to grant continuous access to their banking credentials.

The platform generates structured insights about spending patterns, cash flow dynamics, recurring expenses, and overall financial health. Rather than serving as a transaction-level tracker, Spendify operates more like a comprehensive financial diagnostic tool, helping users step back from daily financial minutiae to assess broader trends over extended periods.

Features and Functionality of the Platform

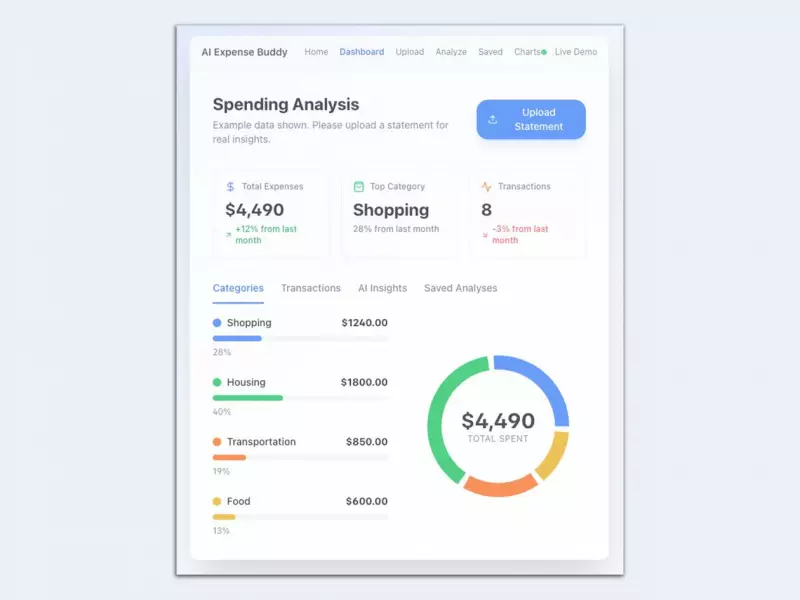

The Spendify Mini Plan emphasizes essential analysis over full automation, offering subscribers several valuable features:

- AI-driven categorization of expenses across multiple accounts

- Interactive dashboards providing visual financial overviews

- Detailed cash flow breakdowns and analysis

- Automatic subscription and recurring expense detection

- Comprehensive financial health scoring systems

- Forecasting tools based on historical financial data

- Invoice creation capabilities for business users

- Multi-statement merging for consolidated financial views

Because Spendify operates through document uploads rather than live connections, it can analyze multiple financial accounts simultaneously without requiring ongoing synchronization. This approach provides users with a consolidated financial perspective that traditional budgeting applications often struggle to deliver effectively.

Accessibility and Market Positioning

Currently available through a limited-time promotional offer, lifetime access to the Spendify Mini Plan is priced at $42, representing a significant reduction from its standard $247 price point. Users can establish accounts and begin uploading financial documents directly through the platform's interface.

Once documents are processed, Spendify automatically generates insights and dashboards without requiring manual categorization efforts. The platform positions itself not as a replacement for comprehensive budgeting systems like YNAB or Rocket Money, but rather as a complementary tool for users seeking periodic financial clarity, enhanced privacy controls, and long-term access to analytical capabilities without recurring subscription fees.

This positioning appears particularly timely in Canada's current economic environment, where concerns about both debt management and data security continue to grow among consumers. As financial complexity increases nationwide, tools that offer both analytical depth and privacy protection may become increasingly valuable for Canadian households seeking to regain control of their financial futures.