Canada's automotive manufacturing landscape, already grappling with U.S. tariffs and the costly shift to electric vehicle (EV) production, is bracing for a new wave of competition. The federal government has announced a significant policy shift that will pave the way for Chinese-made electric vehicles to enter the Canadian market under preferential tariff conditions.

The Details of the New Trade Partnership

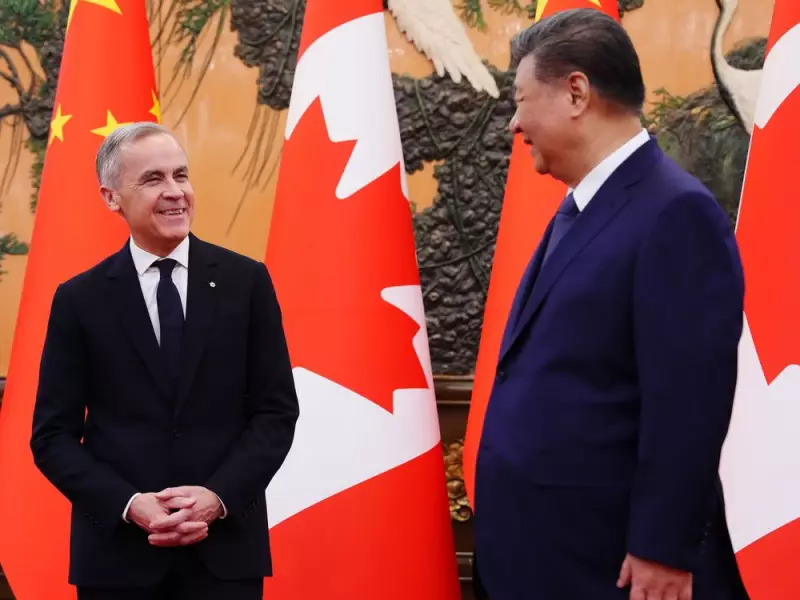

Under a new strategic partnership with China spearheaded by Prime Minister Mark Carney, Canada will permit the import of up to 49,000 Chinese-manufactured EVs at a drastically reduced tariff rate. Instead of the existing 100 per cent tariff imposed in October 2024, these vehicles will now face a levy of just 6.1 per cent. In exchange, China has agreed to lower its tariffs on Canadian canola seed to 15 per cent from 100 per cent, among other concessions.

While 49,000 units represent less than three per cent of the over 1.9 million new vehicles sold annually in Canada, analysts warn the allocation could be strategically used to establish a powerful foothold. The Prime Minister's Office (PMO) projects that more than 50 per cent of the imported Chinese EVs will have an import price under $35,000 within five years, a move the government frames as creating new, lower-cost options for consumers.

A "Trojan Horse" for the Canadian Market?

The policy has drawn sharp criticism from industry representatives and labor unions. Stephen Beatty, a former Toyota Canada executive turned consultant, described the quota as a "bit of a Trojan horse." He noted that selling 49,000 units of a single model in Canada is a feat typically achieved only by top-selling pickup trucks or crossover SUVs.

"If I were the Chinese government, I would not allow this quota to be given away in drips and drabs; I would bet it's going to be allocated in a strategic way," Beatty stated. He warned that if China concentrates the entire quota on one or two best-in-class models, it could allow a Chinese brand to dominate a specific segment of the EV market, undermining billions in domestic EV supply chain investments.

Backlash from Labor and Industry Implications

The immediate reaction from Canada's auto sector has been one of alarm. Unifor, the union representing the largest number of auto workers in the country, issued a forceful condemnation. Unifor National President Lana Payne called the decision a "self-inflicted wound to an already injured Canadian auto industry."

In a statement, Payne argued the policy provides a foothold for "cheap Chinese EVs, backed by massive state subsidies" and risks Canadian auto jobs while rewarding unfair trade practices. The union's concern highlights the tension between trade policy, consumer affordability, and domestic industrial strategy.

The move also poses a potential challenge to current EV market leaders like Tesla Inc., which produced Canada's two best-selling EV models in 2025, though not manufactured domestically. The arrival of lower-priced Chinese competitors could reshape consumer choices and market dynamics.

This policy shift arrives as Canada's auto sector remains heavily focused on internal combustion engine production, with future EV plans still in development, despite existing battery cell manufacturing infrastructure. The federal government's decision to initially raise tariffs to 100 per cent in late 2024 was based on claims of unfair advantage held by Chinese automakers, making this reversal particularly contentious.